CANADA’S FOOD PRICE REPORT 2017 , DALHOUSIE UNIVERSITY

The 7th edition of Canada’s Food Price Report is published for the first time by Dalhousie

University. 2016 marked Canada’s lowest monthly average exchange rate in almost a

decade. Food price decreases at retail were both surprising and unexpected. Due to a lower

Canadian dollar, vegetable prices soared early in the year which prompted Canadians to

become more conscious about food prices in general.1

In many ways 2016 was a difficult

year to predict as weather patterns, the devalued Canadian dollar, a surplus of agricultural

and food stocks, and volatile oil prices drove up food prices.

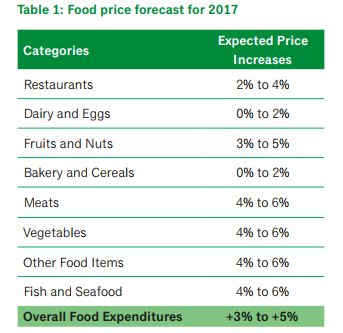

In 2017 food prices are expected to rise above the acceptable inflation rate. The proverbial

sweet spot for food inflation is anywhere between 1% and 2% each year. Such a threshold is

manageable by all stakeholders and allows the industry to provide higher quality products

at an affordable price. Food prices are forecast to rise between 3% and 5% in 2017, which

is both higher than the previous year’s price increase as well as above what is typically

considered as acceptable food inflation.

For the average Canadian family food expenses in 2017 could increase by as much as $420.

The significance of Donald Trump’s victory in November can not be overlooked. Dairy and

eggs along with bakery and cereal are expected to remain stable and within acceptable

inflation rates of 0% to 2%. The same cannot be said for vegetables, fruits and nuts which are

likely to experience a sharp price rise due to high imported quantities. Vegetables are expected

to increase by 4% to 6% and fruit and nuts by 3% to 5%. Deficiencies in the supply chain could

be set in motion by La Nina, a well-known weather phenomenon which occurs following El

Nino. Again, Northern regions are likely to feel the brunt of such increases.

Hog futures are higher in 2017, which suggests pork prices could go even higher next year.

Even though cattle futures are expected to remain flat, we anticipate demand will increase

and push retail prices higher still. The fish and seafood markets are more difficult to evaluate

given the obscure nature of contractual arrangements. Nonetheless, we are expecting retail

prices at the fish and seafood counter to rise due to increased demand across the country

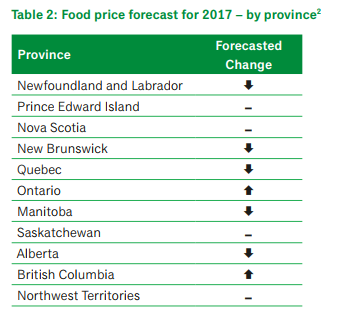

By assessing the level of competitiveness in food retailing and the state of the overall economy,

we are expecting regional differences with food price increases. It is our belief that both

Ontario and British Columbia are likely to experience above average increases in food prices.

Newfoundland and Labrador, New Brunswick, Quebec, Manitoba and Alberta are likely to

experience lower than average increases due to a weaker economy and/or a more competitive

food distribution landscape.