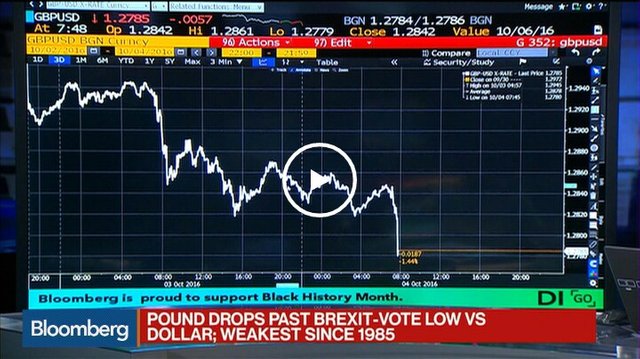

Pound Drops to Lowest Since 1985 as Angst Builds Over Brexit...!!

DON'T BE FOOLED BY THE FTSE..!!

Credit: Bloomberg

Extract from Bloomberg.

[Quote]

"The pound fell 0.7 percent to $1.2747 as of 10:30 a.m. in London, and touched $1.2740, the lowest since 1985. It sank 0.4 percent to 87.62 pence per euro, after dropping to the weakest since August 2013."

Credit: Bloomberg

Don't be fooled in the rise of the FTSE. The Sterling is dropping like a stone forcing the FTSE up but there is no real substance in the Earnings.

A Debt Fuelled Derivatives Rally..!!

The FTSE is on course for a "roller coaster ride"..!!

Thanks for reading please feel free to share.

Stephen

I've been watching this, I feel for the friends in UK and the Euro zone if they haven't gotten their gold and silver yet.

Meanwhile across the pound we have some sweet deals on metals in USD.

Looks like the USD will go out with a bang, just as predicted...

Blessings.

Sterling is dropping so fast it's actually quite scary. Looks like an interest cut is on the cards..!! We are in extraordinary and challenging Financial times..!! Thanks for the support. Stephen

What is your EUR/GBP target?

0.95..!!

I am targeting something similar. Both EUR/USD and GBP/USD to 0.80.

The pound hit a 31-year low against the dollar on Tuesday as British Prime Minister Theresa May insisted on the necessity to set out a timetable for the U.K. to trigger Article 50 and proceed with negotiations to leave the European Union (EU).

“"I want to give people more certainty so we will see a much smoother process as we enter those negotiations," she told viewers in an ITV (LON:ITV) interview.

The interview came after May promised on Sunday that Article 50 would be triggered by the end of March 2017.

GBP/USD hit an intraday low of 1.2737 during European morning trade, the pair subsequently pared losses after an upbeat reading of construction sector activity at 1.2754, declining 0.63% at 6:04AM ET (10:04GMT).

Source: investing.com

The UK is in challenging Financial times and most people are simply hypnotized by the FTSE hitting all time highs. This is a serious problem. It's a rally funded by DEBT, DERIVATIVES, STIMULUS, CORPORATE BOND PURCHASES..!! Dangerous times. Stephen

Agreed, same here with the Dow..

Oh, and man oh man the bonds, whoa... That's a problem looking for a war to blame....

Thanks for your work Stephen. It is at least waking up a few folks :)

Likewise. Keep up the good work. Always great to read your blog. Stephen

What are you building?

"The UK construction PMI jumped to 52.3 from 49.2. The Bloomberg median anticipated further weakness."

http://seekingalpha.com/article/4009933-sterlings-slide-continues-greenback-broadly-bid

No idea..!! Nothing..!! The only thing the UK is building is a roller coaster for the FTSE..!!

Good time to visit then with USD money.

It's never been so cheap for foreigners to visit the UK..!! Stephen