Protect Yourself: Your Money is No Good Anymore

Hi All!

Josh here. I hope everyone reading enjoyed their weekend, especially those in the U.S. we just finished a holiday weekend and I hope you got to spend time with their friends and family. Personally I was visiting family and was lucky enough to spend a couple of days off with them.

Today I wanted to discuss something that was concerning to me in the news this week and that is the Indian Rupee band of certain denominations.

Anyone not familiar with the Indian Rupee band check the link I provided.

My concern me is this: Can this sort of situation happen here in the United States?

... And it turns out that is sure can. Because it's already happen before.

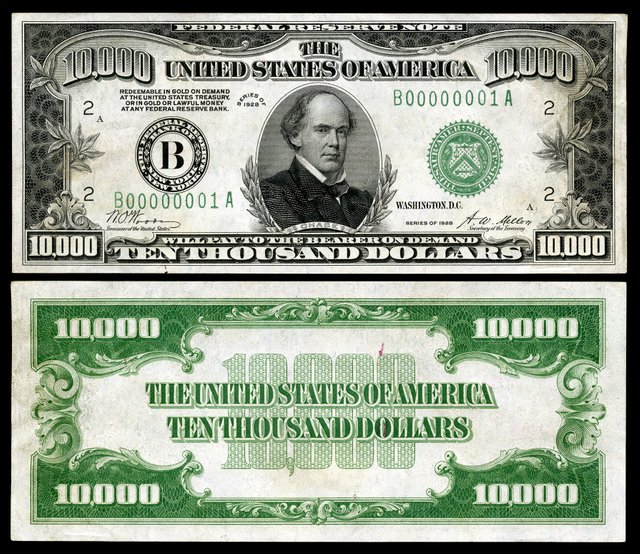

It turns out that the Federal Reserve System has been using a passive retirement of currency since the 1940's. This was to reduce the high-denomination currency in circulation, most 5,000 and 10,000 bills. Once the Federal Reserve received the majority of these bills they started destroying them.

The reason for the Federal Reserve for discontinuing the large bills largely due to lack of use and inflation.

Other bills that have been phased out the United States economy:

"$2" Dollar bill - During the 1966 to 1976 the 2 bills were discontinued and has been produced inconsistently ever since. They are still accepted as legal tender.

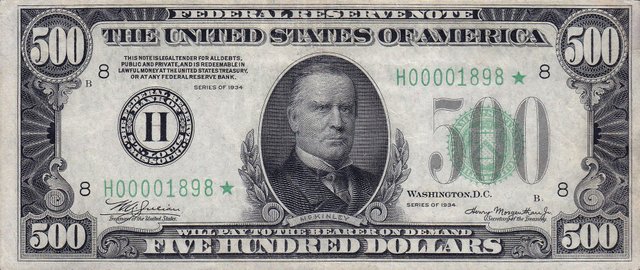

"$500" Dollar bill - Along with the 5,000 and 10,000 bills the 500 bill was discontinued in 1969.

1,000 Dollar bill - Featuring President Salmon P. Chase who was a big deal in politics during the mid-19th century and actually served as first secretary of the Treasury under Lincoln. Inflation was the reason this bill was discontinued. It was also discontinued in 1969.

"$100,000" Dollar bill - Another tragic victim of inflation. Phased out of currency starting in 1945 and discontinued in 1969.

Back to India's Rupee

India has limited the cash withdraws to a maximum of 4,000 Rs when turning in any amount of 500 Rs to 1,000 Rs legal tender. Any remaining amount leftover will be credited to a bank account. Anyone that wants to withdraw cash money from their account is limited to 10,000 Rs a day and 20,000 Rs a week.

The biggest question here is, "Why make such a dramatic change?"

Unlike the U.S. currency fade out of specific bills to beat inflation. According to the Reserve Bank of India the transition was done to reduce the incidence of fake Indian currency in circulation.

This action in conjunction with restrictions on cash withdrawals and a short timeline has resulted in immense frustration of the Indian people.

Let's return to my original question with a slight revision:

Can this sort of situation happen here in the United States NOW?

A good indication that something like this happening in the U.S. is to look at other Western countries. Let's take a look at similar situation of national banks limiting the amount of cash in a local economy in other Western country.

In 2008, the Wall Street crash effected global markets and the following year Greece reviled that it had been understating its deficits to the European Union. In 2010, Greece was heading towards bankruptcy.

Resulting in the Greek government closing all its banks to prevent people from withdrawing their money and discontinued use of the drachma. Essentially forcing the Greek people to use a bartering system for their local economy.

A Good Example from the U.S.

Executive Order 6102 was in enacted in April 5, 1933 by President Franklin D Roosevelt.

"forbidding the Hoarding of gold coin, gold bullion, and gold certificates within the continental United States"

Wikipedia Executive Order 6102

The executive order was a response to the Federal Reserve Act of 1913 that required all U.S. Federal Reserve Notes by backed by a minimum of 40% gold holdings.

It was considered criminal to posses gold, silver or other precious metals of monetary use by any individual or corporation under the penalty of 10,000 Dollars and 10 years imprisonment.

Many protesters at the time complained that if gold couldn't be legally owned, then it couldn't be legally redeemed and therefore couldn't be constrained by the central bank.

The time given to comply with Executive Order 6102 was just one month.

Protect Yourself:

While the U.S. example may not be as extreme as the Greek crisis or the current Indian dilemma it does show that we all should be prepared for our bills to no longer have any type of purchasing power and overall financial crisis.

- Watch your spending and avoid large debt whenever possible. Losing a large portion of the economy like the Indian estimated 86% over night, then include a limit to money access can cause real financial strife and having your property confiscated by debt collector is very real.

- Have an emergency cash on hand. If banks are ordered to freeze or seizure on accounts things can go bad fast and cash on hand will come into play for the short term.

- Water, Food, Gold, Ammunition & Medication: These are some the items that can be traded or bartered with during an economic disruption, considering that most major groceries and markets are going to be short of supplies.

- Develop a skill that's can become valuable no matter how much cash there is circulating. Whether it's farming, first-aid, mechanics or self-defense.

There you have it. Thank you for reading. It is my pleasure to share and help educate.

Please leave your comments and share any additional information you may have on this subject.

... And of course Stay Safe!

100% STEEM POWER!

###Resources:

Money Burn

2 dollar bill

500 dollar bill

1000 dollar

100000 dollar bill

Financial Crash

Executive Order 6102