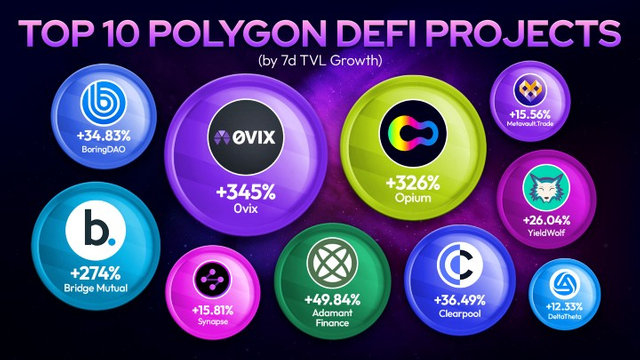

Metavault.Trade an all-in-one platform for spot and leveraged trading

What Is Metavault.Trade?

Traders can use it in two ways:

- Spot trading with swaps and limit orders.

- Perpetual Futures trading with up to 30x leverage on short and long positions.

Metavault.Trade aims to become the go-to solution for traders who want to stay in control of their funds at all times without sharing their personal data. Its innovative design gives it many advantages over other existing Dees:

- Very low transaction fees.

- No price impact, even for large order sizes.

- Protection against liquidation events: the sudden changes in price that can often occur in one exchange (“scam wicks”) are smoothed out by the pricing mechanism design relying on Chainlink price feeds. All-in-one platform: Spot and Leverage trading.

Minting and Redeeming

MVLP can be minted and redeemed by going on the “Buy” page from the header and clicking on the “+ LIQ.”, “- LIQ” buttons in the MVLP boThis will take you to the following screen where you will see a recap of all MVLP characteristics:

- Price.

- Wallet holdings.

- APR

- Total supply

In box 1 you can choose to mint (“+ LIQ” button) or redeem (“- LIQ”) MVLP. You can choose any index asset to spend or redeem using either button 2 or any of the buttons in zone 3.

After having chosen an asset, enter an amount in order to see the fees required in zone 4.

The price for minting and redemption is calculated based on the total worth of assets in the index including profits and losses of open positions / MVLP supply.

Being able to provide/redeem the assets the most/less sought after by the protocol will allow you to lower your fees.

Please note that minted MVLP immediately starts accruing rewards and that there is a holding time of 15 minutes after minting before you can redeem MVLP tokens.

Metavault Trade Decentralized Perpetual Exchange

Trade Top Cryptocurrencies With Up To 30x Leverage Directly From Your Private Wallet.Reduce Liquidation Risks

An Aggregate Of High-Quality Price Feeds Determines When Liquidations Occur. This Keeps Positions Safe From Temporary Wicks.Save On Costs

Enter And Exit Positions With Minimal Spread And Zero Price Impact. Get The Optimal Price Without Incurring Additional Costs.Simple Swaps

Open Positions Through A Simple Swap Interface. Conveniently Swap From Any Supported Asset Into The Position Of Your Choice.Available On The Following Networks

Metavault Trade Is Currently Deployed To Polygon Network And Fantom Opera.Near Protocol Is Coming Soon.Trading

Metavault.Trade Is A Cutting-Edge Decentralised Exchange Platform That Doesn’t Require Registration. To Start Trading On Metavault.Trade All You Need Is A Web3 Wallet.

Supply

The Maximum Supply Of MVX Is 10,000,000. Minting Beyond This Maximum Supply Is Controlled By A 28 Day Timelock, An Eventuality That Will Only Be Considered If The Demands Of The Protocol Necesitate An Increase In Liquidity.The Rate At Which The Circulating Supply Changes Will Be Dictated By The Number Of Tokens That Are Distributed Through Other DEXs, Vested, Burnt And Spent On Marketing:

- 1.2 Million For Marketing, Partnerships And Community Development

- 2 Million For The Metavault DAO Treasury (Staked+Locked)

- 4 Million Reserved For Rewards (EsMVX Reserve For Multichain Expansion)

- 1 Million Paired With USDC For Liquidity On Uniswap

- 300,000 For MetavaultDAO Team (Linearly Vested Over Two Years With A Three-Month Cliff)

- 1.5 Million Allocated To Presale

Important Points Table Of Metavault Trade

- Name: Metavault Trade

- Short Name : MVX

- Max : 10,000,000

MATIC rewards from platform fees

This is the simplest form of reward and the easiest to understand: MVX stokers will get 30% of the fees collected from across the platform in the form of MATIC.

In the case of blockchains other than the Polygon network, the rewards are paid in the native token of the blockchain, e.g. NEAR in the case of Near Protocol.

Metavault.Trade generates revenues by charging traders small fees when they use the platform for the following

- Swaps — fees vary according to the levels of the swapped assets in the pool.

- Opening and closing trades — fee of 0.1% of the position size.

- Borrowing to leverage trade or short an asset — fee of 0.01% * (assets borrowed) / (total assets in pool), deducted at the start of every hour.

Compound or Claim rewards

Users can claim rewards anytime by going to the “Earn” page and clicking on the “Claim” button in zone 1, the “Total Earning” box.

Claiming will transfer any pending esMVX and MATIC rewards to your wallet.The platform also has a one-click way of compounding all rewards. This will be very helpful to users who want to maximize their earnings.

Clicking on the “Compound” button will send a batch transaction with only one confirmation needed. You will see a recap of all the transactions that will happen before confirming the transaction in your wallet:

- Claiming and then staking unvested MVX and/or MVC.

- Staking MPs.

- Claiming WMATIC rewards and converting them to MATIC.

- Claiming WMATIC and compounding them into MVLP or MVX

For more information

- Website: https://metavault.trade/

- Twitter: https://twitter.com/MetavaultTRADE

- Telegram: https://t.me/MetavaultTrade

- Discord: https://discord.gg/metavault

- Medium: https://medium.com/@metavault.trade

Username : Ozie94

Proile : https://bitcointalk.org/index.php?action=profile;u=2103066

Wallet : 0xEfd7255D5b89Ceffa7d0E297b556286C143e779B