Why I Manage My Credit Score

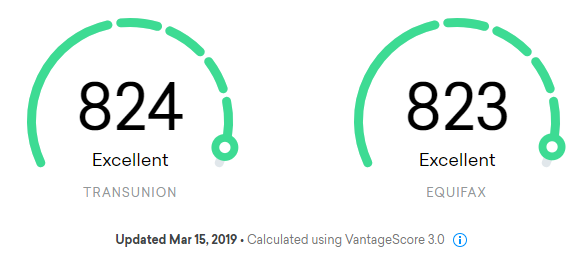

You will save thousands of dollars in the course of your live time. This will also help you reach FIRE quicker as it lowers your burn rate (living cost). Any score above 750 should be sufficient but a score above 800 provides maximum benefits and a nice cushion. I personally keep my score as high as possible to have the option to take advantage of any opportunities that may arise in real estate deals. In the meantime, I am milking my score by churning credit cards for some extra bonus cash.

3 Primary Benefits of Having a Great Credit Score

1. Access to the best rates. The largest benefit for me clearly was the ability to score great rates when purchasing real estate. This alone saved me thousands of dollars in interest savings. The less the bank takes the more for you to invest.

2. Great insurance premiums. Insurance companies use what is known as the “insurance score” that is based of your credit score, to determine your premium. Having a good credit score will save you hundreds from your auto and home insurance. Today, there are literally no brokers or insurance companies that can provide me with a better rate than I have today. That is when you know you have a good deal.

3. Enjoy credit card rewards. You really benefit most here if you are a big spender. For example, if you operate a business where you may utilize credit cards to pay for business expenses. For me, I was able to accumulate thousands of dollars in rewards per year using business credit cards.

These three reasons are where I had the most benefits from having a good credit score. The savings overtime are well over thousands and the benefits only continue so as long as your score remains in good standings.

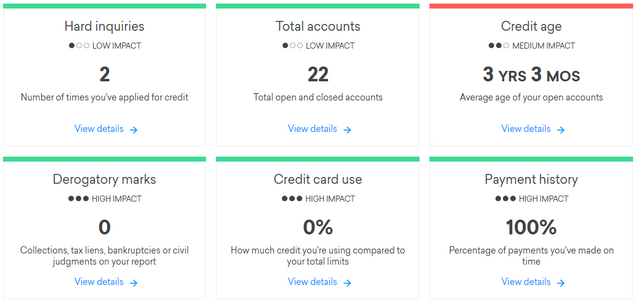

Factors That Determine Your Score

- Hard Inquiries. Keeping your hard inquires below 2 per year is ideal. Each hard inquiry stays on your record for 2 years. Having 4 on record didn’t really have much impact on my score but this factor will vary depending on the length of one’s credit history. The older your credit history, the less impact hard inquires will have on your record. I once racked up around 8 hard hits on my credit report in one month while shopping for mortgage loans and my credit score only fell by 5-8 points. When you need to shop for good rates, don’t worry about the hit on your score and shop for the best rate possible. After all, your main purpose for maintaining a good score is to get that good rate.

- Total Accounts. Having more credit history with banks will help improve your score. My score began improving noticeably once I began having multiple mortgages I was paying off. Personal loans, car loans, or any type of consumer loans in good standing order will likely improve credit scores over time. I’m not saying you should go out and buy a car you can’t afford and get a massive loan. Rather, you can help improve your score by utilizing 0% APR loans offered by some companies. What I did was purchase a car I knew I could pay in full with cash but rather utilized their near 0% APR loan to help improve my score while paying nearly zero interest.

- Credit Age. Do not close your accounts that have been opened for long periods of time. I personally made a mistake by closing 2 of my oldest BOA credit card accounts which dropped my score dramatically in the past. It took roughly around 2 years for my score to recover to its credit score prior to closing. My credit age looks young because I have been doing some credit card churning in the past 2 years. Although this score is low, it does not impact my overall score probably due to other factors mentioned below which are the most important factors.

- Derogatory Marks, Credit Card Use, and Payment History. These 3 are the most important factors to reaching a score above 800. You must not miss a single payment. Your credit card usage should not carry recurring balances that is above 10% of your total credit available from all accounts totaled. Ideally, you would want to pay off all payments in full each month and keep utilization below 10%. Anything above, begins to drop your score. Having any type of liens or bankruptcies will definitely prevent you from reaching scores above 800.

Quick Tip

- Call your bank when you miss a payment. Many issuers will wave your late payment and fees if your account was in good standings for at least 1-2 years. There were times I forgot to make a payment but with a simple phone call was able to remove the late payment record and fees.

- Use free credit score monitoring services. Many companies now offer free credit monitoring services such as Credit Karma and Credit Sesame. Banks such as Chase and Discover also offer free credit score monitoring as well. Reviewing your score once a month may also help you stay on top of any fraudulent activity as well.

Conclusion

The benefits of having a good score may save you thousands over the course of your life. Achieving a good score may not be easy but it is well worth the effort. You are rewarded for being a reliable and responsible borrower by the financial industry through better rates. It is like your reputation score to the world. No one wants to deal with people who are untrustworthy, and this score helps others to determine how they wish to deal with you. Maintaining a good credit score should be in the interest of many who seek to reach FIRE as it will bring down your burn rate to help maximize your wealth building. Tell me what you guys think. Thank you for reading.

Follow me at my website: www.LifeBeyondFIRE.com

Note: I recently created a separate page with all the recommended sites and services that helped me reach FIRE in my life. Feel free to check them out if your interested in resources that may help reaching FIRE.

Congratulations @insidelook! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

The amount of the dropped credit score points depends on the bank and the amount of money you are missing. Suppose you are very worried about your credit score to get a good mortgage. In that case, you will need to address the professional Mortgage Advice Sunderland service that is helping their customers to get the best mortgage offer from the bank. I always approach them if I got any issues with my mortgage or if I am planning to take my next mortgage. They offer the best mortgage conditions for their customer, so be sure you will receive a good mortgage offer.