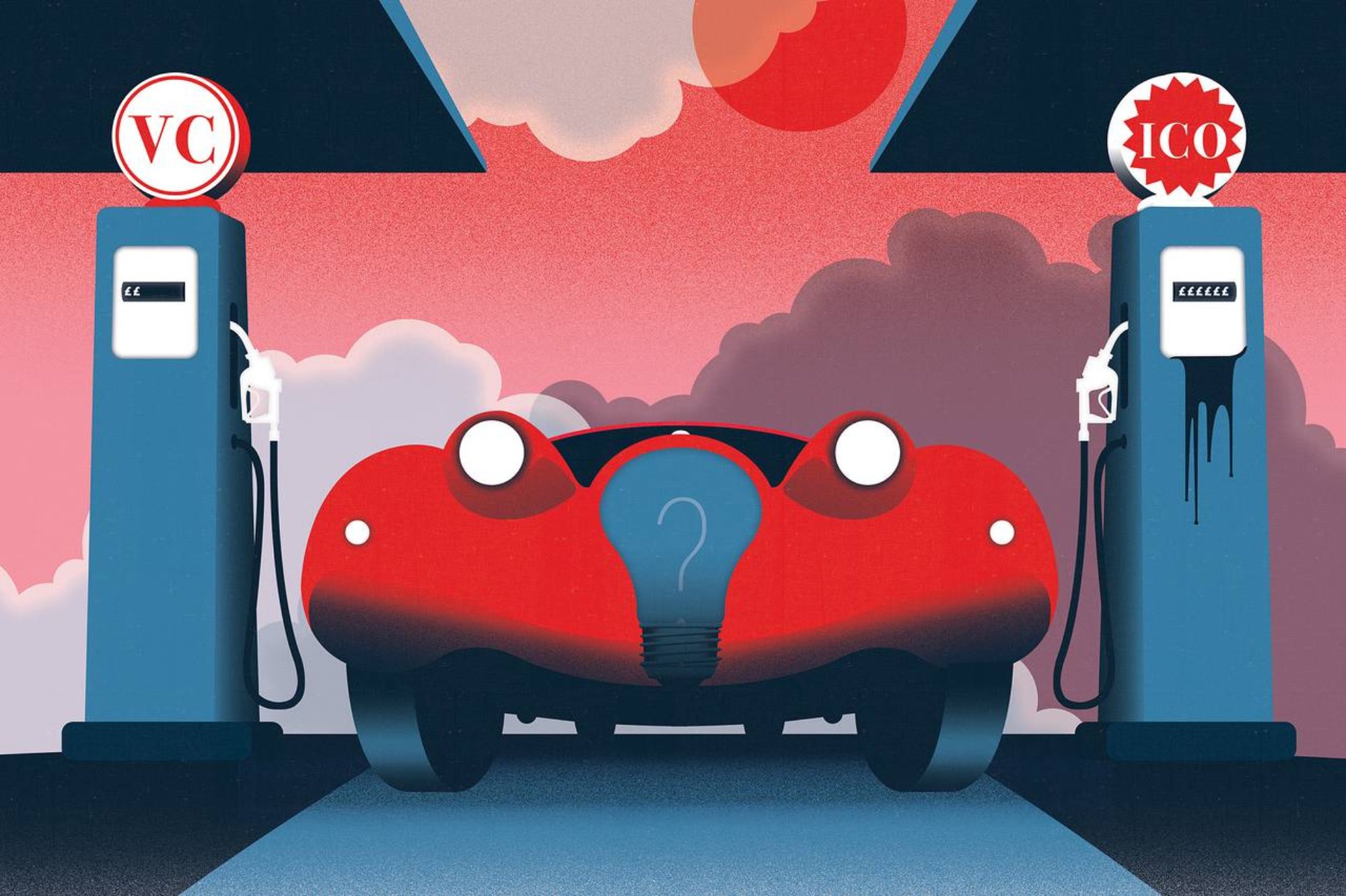

Why beginning coin offerings won't swap funding for new companies

There ought to be no uncertainty at this point beginning coin offerings – token deal fundraising by new companies – have set up themselves as new and extremely convincing types of capital raising.

New businesses, fundamentally in the block chain world, brought $4.6bn up in different types of token dispatches in 2017, a quantum jump from the $0.2 billion raised the prior year. While this may not appear like much contrasted with the $188.8bn brought up in customary IPOs in 2017, five of the biggest ICOs in history occurred in October and November so there is unmistakably solid force.

This has started to upset over all the customary investment display by giving a convincing option raising support system for new businesses. An ICO gives a startup a chance to take its thought straightforwardly to financial specialists for close moment approval through the group, and eases authors of the regularly critical time responsibility expected to seek after raising support through customary means. This thusly gives them more opportunity for their genuine activity: advancement. With an effective ICO, new businesses can likewise possibly meet all their capital needs in a solitary raise as opposed to expecting to continually raise new pursuit subsidizing.

So it is nothing unexpected individuals are starting to inquire as to whether ICOs will make funding outdated. I think the new model will in all likelihood upset the way VC firms work together. Be that as it may, it won't mean the end for them.

VC firms still offer originators a great deal. Their interest in a task is a solid approval of the thought and they can offer important guidance as far as refining ideas and creating strategies for success. While a solitary, widely inclusive financing round through an ICO can be enticing, fortunes can prompt abundances. Financial speculators, which customarily give subsidizing in arrangement of littler rounds, can help guarantee originators stay reasonable spenders and push them to meet due dates and accomplish developments.

There are additionally parts of the ICO showcase that need to develop before it can endeavor to supplant investment.

The greatest region that requires consideration stays administrative vulnerability. While controllers around the globe have by and large been mindful to the ascent of ICOs, and have endeavored to comprehend them, there are as yet various prickly lawful and administrative issues to be tended to. There is uniqueness among wards and most nations still can't seem to address digital money impose inquiries seriously.

ICOs likewise keep on facing a genuine risk that customary types of raising support don't: that of hacking. We have seen cash stolen from token dispatches through misrepresentation, for instance through phishing plans or phony sites, and security imperfections in digital currency wallets. In the event that the ICO people group can't address such digital security issues, it will experience considerable difficulties getting on with standard speculators.

None of which is to state ICOs will be not able manage these issues. Different activities are in progress to enhance control, security and financial specialist insurance.

These incorporate endeavors by the business to control itself, for instance through sets of principles like the one we as of late created at the Crypto Valley Association. Expanded spotlight on digital security is probably going to see more structures intended to ensure financial specialists, for example, bolt up periods constraining speculators to all the more deliberately assess extends and demoralizing 'pump-and-dump' plans, and pre-enrollment prerequisites.

Later on we are probably going to see more organized subsidizing rounds too, with tops, expanded straightforwardness in regards to the requirement for reserves, and inventive approaches to oversee the utilization of assets – from voting by financial specialists to keen contracts to guarantee that pre-concurred capital consumption designs are clung to.

However, for now, in spite of the fact that ICOs are obviously a problematic improvement in the realm of startup subsidizing, they don't remain to supplant customary wander financing – surely not yet.

What's more, even as the ICO business develops there is each motivation to think funding will remain a critical piece of the startup procedure. Investors could work close by ICO's by giving financing and counsel to refine a thought and build up a strategy for success before endeavoring an open subsidizing round.

Truth be told, joining the advantages of both VC subsidizing and ICOs may end up being the best decision for financial speculators, authors and the more extensive speculator group alike.

For new companies, it implies access to vital ability at maybe the most basic minute for the entire wander: its initiation. Furthermore, for VC firms it implies as yet having the possibility of getting in at an opportune time ventures, either with a value share, early cooperation in the inevitable ICO, or both.