The ICO Gold Rush is Here

To give you an idea of how fast this space is moving, I started this article a few weeks ago and have had to revise it three times. The landscape has gone through unbelievable changes in just the last month alone. With a flood of people entering the space, a great number of ICOs selling out before crowdsales, and a host of other factors, we hope this can be of some value before it is possibly outdated by this time next week.— Craig Ritchie, Hash Rush Director of Marketing, 8 February 2018.

Estimated reading time: 8 minutes

In this article:

- Introduction

- An overview of the ICO landscape

- Proponents and people to follow

- Telegram as a measure of ICO hype

- Is it the beginning, or the end?

- Regulation 101

- Always Stay Safe

Introduction

In this article, we — the marketing team at Hash Rush — want to look at what relative newcomers to the space should know before committing their cryptocurrency to investing in an ICO. This is not a ‘what is an ICO?’ article, nor does it cover tips to run a successful ICO, which we wrote about last month.

Rather, in this article we focus on people who want to participate in ICOs — giving a few pointers and suggestions to help you on your way, and providing a brief introduction to the regulatory framework currently in the works.

An overview of the ICO landscape

There’s been an absolute explosion of ICOs over the last few months: ICO celebrities have emerged, stories of 100x gains, overnight millionaires and all the rest. You know, the kind of stories that attract people hoping to mimic the same success. Who doesn’t want quick, easy money? But as a good friend said to me, “ICOs are easy money. But easy money doesn’t stay easy for long”. This was around the first week of January, and his prediction has come true way earlier than we expected. But more on that later…

Proponents and people to follow

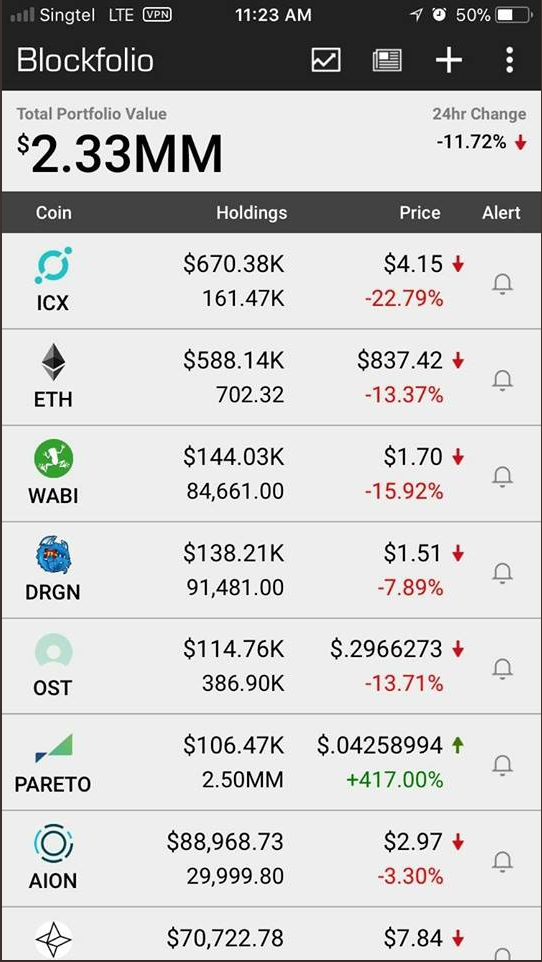

Money attracts money, and crowds attract crowds. Proponents in the ICO space publicly showing their gains attract both. The most notable is now arguably the world’s first ICO celebrity, Ian Balina, who has made a huge contribution to fueling the ICO frenzy. Balina had 45,000 YouTube subscribers when we started researching this article. He now has 99,773 and counting. Similarly, he had 50,000 Twitter followers during this article’s first draft. That figure is now at 119,000.

Regardless of your opinion of him, it's worth following Balina’s on Twitter — not the least because his tweets can make or break a crowdsale. It’s not uncommon to see him tweet positively about an upcoming project, increasing the project's Telegram subscriber count by tens of thousands overnight. He also reviews ICOs on his YouTube channel. His method, while a little conservative for some, clearly works.

If you want to broaden your landscape, also check out these other prominent ICO-focused YouTubers:

- Crush Crypto (25,000 subscribers)

- Coin Bloq (18,780 subscribers)

- TheGobOne (11,846 subscribers)

- OhHeyMatty (10,959 subscribers)

There are numerous groups on Discord discussing and reviewing ICOs, and they make for a great place to start — if you can get in. Google for some possible groups, or watch videos from the above posters for openings or waitlists. Many also have publicly viewable spreadsheets of their ICO ratings.

Again, Balina is a frontrunner here with a very detailed sheet you can view here. OhHeyMatty is also very active in updating his spreadsheet, which he often does during his ICO review videos. And a good resource for an overview of the sentiments of some of the key influencers in the space can be found in this spreadsheet, maintained by Top 7 ICO.

Telegram as a measure of ICO hype

One of the easiest ways to measure an ICO’s hype is looking at how many members its Telegram channel has. Refereum, a blockchain-based videogame referrals marketplace, recently broke all channel size records and led to Telegram increasing the maximum user size per channel.

While this is of course far from any objective measure of quality (if there even is such a thing), it definitely is a measure of hype and attention. That alone can be very telling of a project’s future. ICOWhitelists is a great place to have a quick glance at the largest groups, as well as those who have seen spikes in membership.

Almost every ICO now has a Telegram channel — it’s an important place to check in, and sometimes ICOs are only open to people who whitelist via their Telegram channels. But as always, watch out for scammers. They’re everywhere, and never trust a PM from someone claiming to be a moderator or a team member; verify their identity with a confirmation message in the project’s channel (where they will have ‘admin’ next to their name).

And just as a final note on this topic: bear in mind that many of the huge Telegram groups have reached these high figures either because they have a referral program incentivising participants to invite others, or are promising a token airdrop to Telegram members. So it's not a pure, cut-and-dry indicator of the long-term success of the project by any means.

Is it the beginning, or the end?

It could be that ICOs are genuinely the new IPO, where investors don't need to go through a middleman in order to invest. If you spot a good project, research the team, and are impressed by their prototype, then why shouldn’t you invest? It’s exactly this fundraising method that made Hash Rush possible, after all!

But as mentioned above, easy money does not stay easy. Whales — those with hundreds or even thousands of ETH to throw at projects — are getting in on ICOs in the private or pre-sale stages, buying up huge allocations early. This means that by the time the crowdsale begins, there’s less to go around. The squeeze is felt even more on the really hyped projects, so that by the time the public sale starts, there are only very small pieces of the pie left. Some examples are BeeToken, WePower and Fortuna, which only managed a 0.2 ETH allocation per person when their crowdsales opened. It’s great for these projects to get such amazing support, but definitely left some would-be investors wishing they could have acquired more tokens.

As we’ve seen, there are a lot of people making a lot of money right now, but as there’s always risk involved, many people are likely to lose out too. This is where regulators step in. Depending on one’s cynicism, regulators can be seen as either here to protect people from being scammed and losing money — or here to prevent the democratisation of ownership of these projects, thus slowing the redistribution of wealth from the few to the many. There’s probably a bit of both going on.

Regulation 101

Some crypto enthusiasts see regulation as the biggest ‘threat’ to the future of ICOs. Already, citizens and residents of the United States and China are not permitted to participate in ICOs unless they are accredited investors. The SEC moved quickly in July to class DAO Tokens as securities, and China simply did an outright ban on ICO participation.

There’s some speculation that the Chinese ban on ICOs may well be temporary, but just this week we’ve seen more news of China proposing an all-out ban on foreign cryptocurrency exchanges. Let’s hope this is not permanent, as the same money that’s now being prevented from moving across borders could be used to support innovative projects and startups taking advantage of the ICO rage.

Our American friends are already under harsh regulations and are largely excluded from any ICO participation. On 4 January, the North American Securities Administrators Association (NASAA) also joined the fray issuing a statement warning investors to go beyond hype and look seriously at the risks involved. Decent advice no matter what you’re thinking of putting your money into — crypto or otherwise.

Another potential stumbling block is the step taken by JP Morgan Chase & Co and Citigroup to ban the use of credit cards for cryptocurrency purchases. Following suit just hours later, in what seemed far too coordinated to be pure coincidence, Lloyds Banking Group banned its customers from using credit cards to buy cryptocurrencies.

While we can understand the sense in preventing clients from borrowing money to make speculative investments, credit cards are not only a means of easy lending. For some who may well have the necessary capital, they’re simply a convenient method of payment. Note that debit cards and bank transfers seem unhindered, from what we’ve been able to tell. This is going to be an interesting story to watch unfold.

On the other hand, Australia is an example of a country controlling what it can within its own borders, but ultimately leaving the risk up to the investor if they want to participate in internationally run ICOs. ICOs operated from within Australia will have to comply to strong regulatory guidelines, and while the general public is free to risk their money as they see fit, they are warned that “if the company is not registered and does not have a licence in Australia, investors will have little protection if things go wrong” (read this article from The Conversation or ASIC’s own page to learn more). There’s currently no word on whether or not Australian banks plan on also halting crypto purchases using credit cards, but we’re watching it closely.

Always stay safe

As with anything in this space, do your own research and understand the legal framework for your own country, as well as the tax implications for gains made on ICOs. It would be a shame to 100x and reach the moon only to have the tax man and his handcuff-wielding friends come knocking on the door because you were too busy picking out your seventh lambo to file an accurate tax report.

And of course, on top of regulatory and legal considerations, general security should always be front of mind as there’s a growing number of scammers moving in to the space as well. Just this weekend the ICO for the highly-hyped project ‘Seele’ encountered a massive setback when scammers impersonating Seele staff made off with almost $2 million in Ethereum. This shows again how important it is to protect your funds (for tips, check out the Beginner's Guide to Staying Safe in the World of Crypto).

Where we go from here

Make no mistake, the wild west days of simply saying ‘send us ETH and we’ll send you tokens’ may well and truly be ending. Today saw a landmark hearing before the Senate Banking Committee where the SEC and CFTC presented testimony that will no doubt play a major role in the regulatory future of this still very nascent space. You can read the statements in full here (J. Christopher Giancarlo - CFTC) and here (Jay Clayton, SEC) — but initial reports are that this is very positive for the future of ICOs and crypto in general.

If this opens the floodgates to millions of US-based investors, it will be fantastic for the crypto economy, but will likely make the good ICOs even harder to secure a place on those coveted whitelists. And, expect more stories of people being scammed out of their money, unfortunately.

In conclusion, it’s a great time to be involved in this space, but it’s far from easy, safe money.

For the latest Hash Rush news, go to our website, follow our blog, join our newsletter or talk to us on Discord!

Thanks for posting this. Nice to see an article that's not just further hyping this (imo getting pretty insane) bubble, but rather also voicing a word of caution to investors.

Glad to read that you like the article. We might be one of the rare voices that whisper caution, but it's something that's really needed.

That said the ICO scene has opened to door to some really amazing projects!

http://www.sl8pool.io

This post has received a 1.39% upvote from thanks to: @hashrushgame.

thanks to: @hashrushgame.

For more information, click here!!!!

Send minimum 0.050 SBD/STEEM to bid for votes.

Do you know, you can also earn daily passive income simply by delegating your Steem Power to @minnowhelper by clicking following links: 10SP, 100SP, 500SP, 1000SP or Another amount

Hi Hashrushgame,

I have read few of your articles, and i enjoyed reading them and they are quite informative so though to give you heads up about a competition we are running. https://steemit.com/cryptocurrency/@moworks/win-shping-in-60-seconds . Best of luck and happy producing!

Steemit

Win SBD & SHPING in 60 Seconds — Writing Competition — Steemit

All you have to do is produce one-minute worth of content (200–500 word article, one-minute video or one-minute… by Moworks

Some good advice here. Yeah its crazy, it seems like there is a new ICO being launched nearly everyday.