I asked ChatGPT some questions about How Steem Can Attract More Investors. Let's discuss what can be done

Image search pixabay.com

Attracting more investors to Steem is essential for the platform's growth and sustainability. To do this, Steem needs to showcase its unique value proposition, improve its infrastructure, and actively engage with potential investors. Here’s how Steem can attract more investors:

1. Enhance Token Utility and Value Proposition

Diversify Use Cases: Steem’s primary use case as a content reward mechanism can be expanded into other areas like decentralized finance (DeFi), non-fungible tokens (NFTs), and gaming. By integrating STEEM into a broader range of applications, the token becomes more valuable and appealing to investors.

Introduce Staking and Passive Income Opportunities: Offering staking rewards or yield-generating opportunities for holding STEEM can attract investors looking for passive income. This could involve staking STEEM to earn interest or receive additional rewards, incentivizing long-term holding and reducing market volatility.

Burn Mechanisms and Inflation Control:

Image search pixabay.com

Implementing mechanisms that burn a portion of STEEM or control inflation can help manage supply and increase the token’s value. A deflationary model, where tokens are regularly removed from circulation, can create upward pressure on price, attracting more investors.

2. Strengthen the Steemit Platform and Ecosystem

Improve User Experience and Accessibility: A user-friendly interface, faster transactions, and better security features can make the platform more attractive to new users and investors. Enhancing the mobile experience and integrating with other social media platforms can also broaden Steem’s appeal.

Develop Partnerships and Integrations: Collaborations with other blockchain projects, businesses, or influencers can increase STEEM’s visibility and utility. Integrating STEEM with popular DeFi protocols or allowing its use in e-commerce could attract investors interested in cross-platform opportunities.

Expand Developer Tools and Resources: Providing better tools, APIs, and support for developers can encourage the creation of new applications on the Steem blockchain. More projects built on Steem can drive demand for the token, making it more attractive to investors.

3. Increase Marketing and Visibility

Targeted Marketing Campaigns: A well-executed marketing strategy that highlights Steem’s unique features and growth potential can attract new investors. This could involve educational content, influencer partnerships, and active participation in blockchain and crypto conferences.

Transparency and Communication: Regular updates from the development team, transparent roadmaps, and clear communication can build trust with potential investors. Investors are more likely to commit to a platform that is open about its progress and challenges.

Leverage Success Stories: Highlighting successful projects and individuals who have benefited from Steem can be a powerful tool to attract investors. Case studies, testimonials, and media coverage of Steem’s impact can serve as a strong endorsement.

4. Foster a Strong, Engaged Community

Incentivize Community Participation: Engaging the community through rewards for participation, content creation, and curation can keep users active and attract new ones. A vibrant, active community signals a healthy platform to potential investors.

Support New Users: Offering onboarding assistance, tutorials, and mentorship programs for new users can help them navigate the platform and stay engaged. A steady influx of new users increases platform activity, which is attractive to investors.

Host Contests and Events: Regularly organizing contests, challenges, and community events can boost engagement and create buzz around Steem. These events can attract both new users and investors looking for active, innovative platforms.

5. Engage with Institutional Investors

Tailored Investment Products: Developing investment products or funds specifically for institutional investors can open up new sources of capital. These products could offer exposure to STEEM through traditional investment vehicles like ETFs or mutual funds.

Build Relationships with Blockchain Investment Firms: Engaging with investment firms that specialize in blockchain and cryptocurrency can help Steem attract larger-scale investors. Hosting presentations, webinars, and meetings with these firms can increase their interest in Steem.

Highlight Potential Returns: Providing detailed analyses of STEEM’s past performance, future potential, and unique market position can attract institutional investors who are looking for high-growth opportunities in the crypto space.

6. Focus on Innovation and Future Growth

Explore Emerging Technologies: Steem can attract tech-savvy investors by integrating cutting-edge technologies like AI, machine learning, or advanced smart contracts. Innovation signals a forward-thinking platform with the potential for long-term success.

Roadmap for Future Developments: A clear and ambitious roadmap that outlines future developments, upgrades, and new features can give investors confidence in the platform’s growth potential. Regularly achieving milestones on this roadmap can further build trust.

Sustainability and Scalability: Demonstrating that Steem can scale sustainably as user numbers grow will be key to attracting investors. This includes managing network congestion, transaction fees, and ensuring the platform remains efficient even with increased usage.

Conclusion

Attracting more investors to Steem requires a multi-pronged approach that focuses on increasing the utility of the token, improving platform infrastructure, engaging the community, and actively marketing the platform’s potential. By addressing these areas, Steem can enhance its appeal to both individual and institutional investors, driving growth and ensuring long-term success.

What do you think should be done?

INFO

Steem-Power-August-Promotion 🌟

If you want to know more about Steem-Power-August-Promotion click here

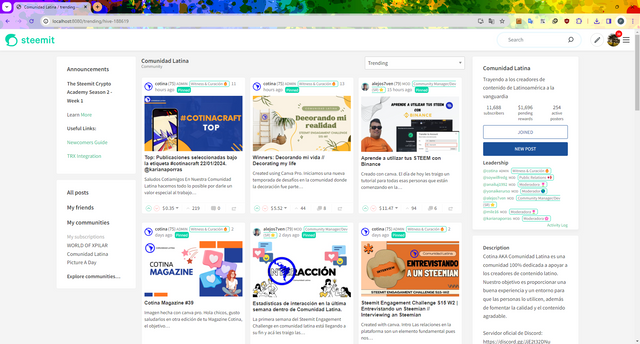

A new Steemit interface? With your vote it is possible

The developer @the-gorilla has been working on a new and better look for the steemit.com interface for a while which also means moderating the condensers Remember to vote for his proposal, click here

xpilar.witness

Voting for me:

https://steemit.com/~witnesses type in xpilar.witness and click VOTE

Founder of @wox-helpfund

If you want to know more about @wox-helpfund click here

Good theoretical advice, but who should do all this? For example: Engage with Institutional Investors. Who should communicate with them? Team Steemit? But they want to stay out of such processes. Then who?

Diversify Use Cases. Unfortunately, we haven't made any progress here for years.

Targeted Marketing Campaigns. I try to do this, but it requires significant resources. Resources are hard to come by because there is no guarantee that marketing will do more good than harm from selling STEEM.

The issue of attracting investors is very complex. The whole project rests on the faith of investors that one day they will sell their STEEM at a higher price and make a profit. This is not a very reliable basis. It is necessary to gradually change the economic model, it is necessary for the blockchain to "earn", and this requires a lot.

You've raised some important and challenging points about the difficulties in attracting investors to Steem. Indeed, the issues you've highlighted—such as the lack of a centralized team to lead investor engagement, stagnation in diversifying use cases, and the resource-intensive nature of marketing—reflect the broader complexities of growing a decentralized blockchain project.

Addressing the Challenges

Who Should Engage with Investors?

Diversifying Use Cases

Targeted Marketing Campaigns

Changing the Economic Model

Attracting investors to Steem is indeed complex and requires coordinated efforts across multiple fronts. Since the platform is decentralized, leadership on these initiatives will likely need to come from a mix of community leaders, developers, and stakeholders who are willing to take on these roles. Collaboration, innovation, and a willingness to experiment with new strategies are crucial for overcoming these challenges.

Ultimately, the key is building a sustainable ecosystem where the value of STEEM is not solely dependent on speculation but is driven by real use cases, community engagement, and the success of projects built on the platform.

Those are all really great suggestions - now if we can execute on them…

Hi @brian.rrr

Willingness must be present to initiate to be able to do it, start small and then do more. but some be willing to form a group and be able to plan

Amazing

Steem is a very good initiative but with today's rates we have to make projects worth our time I don't want to be here wasting time while there may be better avenue's for success as this was the Idea we joined steem in the first place..

It's the simple things imo. I'm a newbie and I'm definitely not complaining, but there's quality of life issues most casuals won't bother with. Starts with the search function. I'm sure it works beautifully for those who understand it, but I don't. Finding communities seems kinda awkward and then there's the issue with the URLs. With reddit I can just remember the /r/whatever and share it without having to copy/paste some hive designator. There's bookmarks, sure, but that also falls flat as soon as I use another device. So I'm digging around again. Take like 30 seconds to be fair, but most people just won't do that.

"I'm so impressed by the thorough analysis of how to attract more investors to Steem! 🤩 The suggestions for increasing token utility, improving platform infrastructure, engaging the community, and actively marketing the platform's potential are spot on. 📢 I particularly love the idea of integrating cutting-edge technologies like AI, machine learning, or advanced smart contracts - innovation is key to long-term success! 💡 It would be amazing to see Steem continue to grow and evolve with these ideas in mind. What are your thoughts on this? Should we prioritize any of these suggestions over others?"

I also gave you a 91.18% upvote for the delegations you have made to us. Increase your delegations to get more valuable upvotes. Cheers! 🎉

Help Us Secure the Blockchain for You

Your vote matters! Support strong governance and secure operations by voting for our witnesses:

Get Involved