Central Banks Hoarding Gold: What It Means for Investors

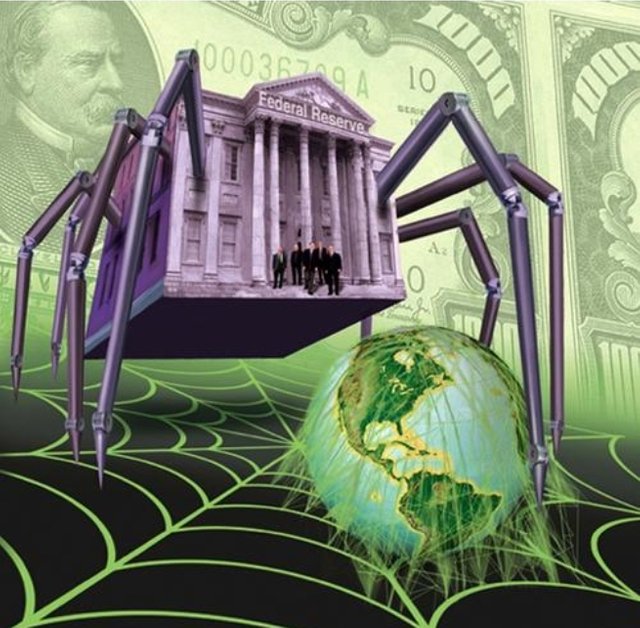

Gold has reached an all-time high, surpassing $2,600 per ounce, and much of this surge can be attributed to central banks and governments hoarding gold. While they advise citizens to invest in traditional markets, their own actions tell a different story—they’re accumulating gold at record rates. This growing demand from the world's largest financial players is a clear signal for investors to pay attention.

Why Are Central Banks Buying Gold?

Central banks accumulate gold to diversify their reserves and protect national wealth from economic instability. Gold serves as a hedge against inflation, currency devaluation, and geopolitical risks. With global tensions and economic uncertainties rising, central banks are stocking up on gold to shield themselves from future crises. Countries like China, Russia, and India have been especially aggressive in increasing their gold reserves, recognizing its value as a stable store of wealth.

Follow the Money: What Gold's Rise Means for You

As governments and financial institutions increase their gold holdings, the price of gold has skyrocketed. This isn’t just a coincidence. When central banks buy large amounts of gold, it drives demand, pushing prices higher. Watching how they invest offers valuable insights for individual investors.

While governments may encourage you to invest in bonds, stocks, or fiat currencies, their own actions show they trust gold. If the most powerful financial entities see gold as a safe bet, it might be time for individual investors to take notice too.

Gold: A Hedge Against Uncertainty

Gold’s value lies in its ability to remain stable when other markets are volatile. In times of economic turmoil, gold acts as a safeguard. With central banks leading the charge, the rising demand signals that gold is viewed as an essential hedge against future uncertainty.

Investing Like a Central Bank

While central banks have the resources to move markets, individual investors can still take advantage of the same strategy. Owning gold not only protects your wealth but also aligns your portfolio with the strategies of the world’s most powerful financial institutions. As gold prices reach new highs, following the example set by central banks may be one of the smartest investment moves you can make.

In a world of economic unpredictability, governments and banks are showing their hand—and it's stacked with gold. Shouldn’t yours be too?

40+yr old, trying to shift a few pounds and sharing his efforsts on the blockchain. Come find me on STRAVA or actifit, and we can keep each other motivated .

Proud member of #teamuk. Teamuk is a tag for all UK residents, ex-pats or anyone currently staying here to use and get a daily upvote from the community. While the community actively encourages users of the platform to post and use the tag, remember that it is for UK members only.

Come join the community over on the discord channel- HERE

Want to find out more about gold and silver? Get the latest news, guides and information by following the best community on the blockchain - silvergoldstackers. We're a group of like minded precious metal stackers that love to chat, share ideas and spread the word about the benefits of "stacking". Please feel free to leave a comment below or join us in the community page, or on discord.