RobiniaSwap Blokfield.INC: a Defi approach towards earning passive income

Gimages

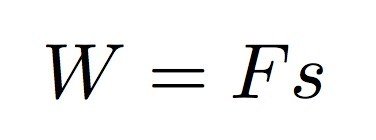

In physics, work is the Energy transfer to an object Via Force along with a displacement

This is mainly what PoW is all about.

- They're has to be a force that generates a Return Or Yield of Power*

However, that model is no longer serves as well as it used to where AMM (Aautomated Market Maker) is introduced

because when the Power Of Assets is introduced, everyone can layoff that rusty power grid and rely on their Raw source of power, it's the Gas that Ether needs and you're holding it right in the palms of your hand.

it is what creates a Liquidity Pool. it is the Surface that needs to be fell with RBS native tokens of RobinaSwap Defi project.

In other words, instead of holding whatever asset within your possession. you can simply earn some interesting returns (APY) through farming in a DEFI.

All you have to do is providing Liquidity to that pool then, you'll have a direct impact upon it and to be directly affected by its rewarding Yield, depending on how impactful you were( the amount of your contribution).

A Defi farm works on balancing its tokenised mechanism. it's somehow seeking a private porsh on top of the Blockchain and over the Mareket's chanting Opera of Coins.

the risk however that unfolds behind this type of business is mainly about the unexpected drop of value of the market as a whole that it results in an "impermanent loss" case towards LP's (you)

this impermanent loss could however be permamnent if the Lp provider withdraws his assets unexpectedly from the Pool.

this phenomena of a collective drop of value is called "Slippage" where the whole market gets on a slide.

after the slippage and if the market recovers the loss would be no longer a loss and it even recovers the API and everything gets back to normal like nothing ever happened.

anyhow, it is always for you and you only to take such risk.

Now that after we understood what we will be dealing with, Let's head directly to:

Show me how it's done

- 1st, in order to be able to lay hands on the RBS tokens and LP rewards (distributed accordingly on Lp's via their added value) you need to

deposit BNB (binance native) because RobiniaSwap operates on BSC model (BEP-20)

by the use of MetaMask it enables you to bridge your way into the Defi system here's how

To sum up...

your participation in the Defi's World is priceless. as it's ought to be seen and considered to be One of the most rewarding endeavors in 2020-21 with a Total Value that surpasses $95B according to Defi_pulse_charts.

Robinia's launch will be the 1st of this October, a stunning work made by @crypto.piotr and Team @RoadOfRich

reblog&vote @racemlaadhar

I like the physical example you show us about RobiniaSwap being like the concept of work being equal to force times displacement, it really helped me understand what RobiniaSwap is all about.

Greetings and thanks for sharing important information.

You're more than welcome, @carlos84

Thanks for your feedback

hi @racemlaadhar

I found small typo: it's not Robina but Robinia (so title and hashtag would need to be corrected)

cheers, Piotr

I've uploaded it, thanks for the remarque

Dear @racemlaadhar

Nice to see that small update about RobiniaSwap project. Let's all hope that this project will be succesful.

Do you know by any chance how to mine RBS? I've never mined any tokens and I wanted to try to do it this time around. But I've no idea how to even start ....

Cheers and have a great weekend ahead of you,

Piotr

Yes, robiniaSwap looks promising at a glance. And persistence is very crushal in such endeavors.

Best of luck mate ☺️

First of all very nice update given by you , but I am still confused how to mine the rbs. If you have any information regarding the same I definitely love to know about it.

Hi, @adityajainxds thanks for your comment.

Her's The thing, in YIELD FARMING. The concepts are basic and not complicated as it maybe seen at a glance. However, "mining" as a vocab is more likely to be applicable to POW (proof of work) that includes actual GPU force to generate revenue.

Although, in This case. We as Lp's we're not providing any concrete power. It's the power of The assets that its put in motion.

Therefore, you'll be dealing with 2kind of rewarding mechanism

Yield Farm APR calculations include both:

LP rewards APR earned through providing liquidity and;

Farm base rewards APR earned staking LP Tokens in the Farm.

And that's it. It's basically stacking but what you're holding is is ALIVE not frozen in a wallet

Solid comment @racemlaadhar

Thank you @crypto.piotr