The Crypto Blood Bath Month has come to Stay - Will FED cause a change in the crypto market?

The bloody September has financially come to stay. It started with a bearish trend in the crypto space. The crypto index is still indicating extreme fear and this month, it has increased to 16% fear which shows that September would not be a good month for crypto. It was observed that there were lots of adoptions into the crypto space but none of these did justice to the price of bitcoin.

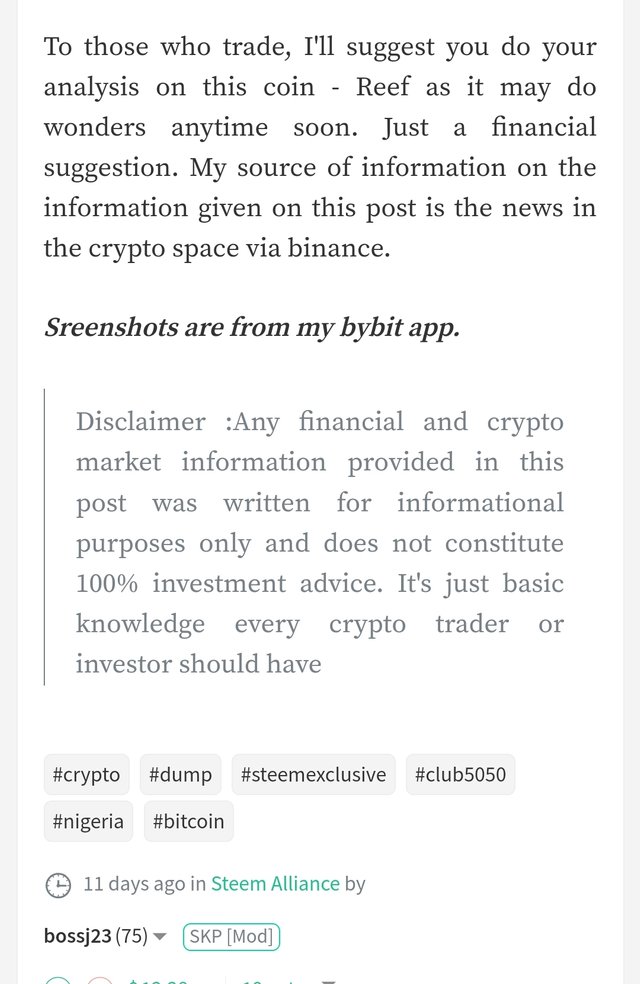

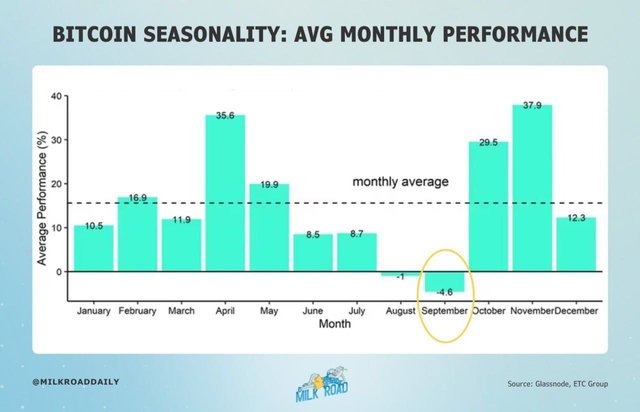

** The known Toncoin for its resistance when bitcoin falls is now falling as low as $4.6.** September didn't start well which was a great sign that as history would have it, this year's September won't be an exception as September from previous years has always been red down to 7%. This is the chart that shows this. Before venturing into what happened earlier this month, I'd love to bring our minds back to the information I dropped 12 days back.

It was actually a rough analysis I did that Reef coin will pump despite the market condition and starting 1st of this month, it showed great signs and wonders despite the bearish movement in the price of essential assets. Using some complex technical tools coupled with how this particular coin is traded, I took a buy position at $0.006 and luckily for me as predicted, the coin shot to $0.0012.

|  |

|---|

All I needed was a little patience as losses were part of holding this coin. Another analysis would be done following this month's trends. As said earlier, the month started with a bearish setting and would continue going bearish as expected though there'll be some bullish corrections before the main pump around October. Let's see some events that unfolded during the beginning of this month.

Bitcoin's price fell to $56k as of September 2nd which was expected with a liquidation on long positions above $1.12 billion. This was huge though. The shorters did make their profits and a lot of traders are waiting for some corrections to be made so they can place their positions.

Such liquidations in the market as demonstrated in the liquidation charts show the extent to which assets reaching a certain level would be affected. This is indicated in the bars as higher liquidation bars shows that the price of bitcoin reaching such level will result in a more intense reaction and may cause more dumps.

Market analysis shows that this September not being an exception for bitcoin's dump historically may reach an average percentage decline of 6%. Coins like BNB, XRP and ETH drop though not really significant as September 2021 during the last bull season. The dump actually started last week Friday as a result of some outflow of bitcoin worth $173M.

The traditional market in US remained closed due to the labour day holiday and if you can recall what happened last month when the market experienced it all time low that month, was because the market was closed on a Sunday leading to dumps. Analysts noticing the movement of a bearish trend this September suggested that potential interest rate cut by the U.S Federal Reserve System could alter the bearish trend which has been a history for years.

** If Fed cuts the interest rates in September, bitcoin might pick up from the historic bearish trend, strengthening bitcoin's outlook as a major store of value** and will also lead to an increased flow of U.S dollars in the economy. For this week, analysis has been made in how the market will look. As of Monday which passed, the U.S stick market closed for the day and today being September 4th, the bank of Canada is yet to announce its interest rate decision if it would be cut or not.

Thursday being September 5th and Friday 6th, the U.S August unemployment rate would be released and we would be anticipating speeches from the Federal reserve officials of US. The probability that the interest rate being cut is slim says some expertise who analyse from the market that if economic data this month shows significant pressure, the 50 basis point rate cut can be possible meaning that in a year, they'll be a rate cut twice but if it's the reverse, it still remains 25 basis point rate cut.

So while we are awaiting the decisions by the US federal Reserve which would affect the inflow of US dollars in the economy and crypto as a whole, we should play wisely to avoid losses.

Sreenshots are from my bybit and telegram app

Disclaimer :Any financial and crypto market information provided in this post was written for informational purposes only and does not constitute 100% investment advice. It's just basic knowledge every crypto trader or investor should have

https://x.com/bossj23Mod/status/1831364023214030946?t=lTDvnspqMLCv5fUycga_pA&s=19

"Wow, what a comprehensive post! 🤯 I love how you break down the September bearish trend in crypto and analyze the potential implications for Bitcoin's price. Your Reef coin analysis is also fascinating, especially considering it pumped despite the market conditions! 💥 It's always exciting to see your predictions come true! 😊 The screenshot from your Bybit app is super helpful, too. Great job sharing your knowledge with us! 👍 And don't forget, if you haven't already, please vote for xpilar.witness by going to https://steemitwallet.com/~witnesses - we're counting on your support to keep improving the Steem ecosystem! 🙏"

Note:- ✅

Regards,

@jueco