Is candlestick trading easier?

Candlestick trading has become more and more popular over the past few years and I am always asked what chart type or chart form would be best for trading. In this article I would like to answer this question.

The price movement of stocks, futures markets or foreign exchange can be represented in various ways. The most common chart types are:

line chart

Point & Figure Chart

Bar chart

Candle Chart (candlestick chart)

Bollinger bars

Kagi chart

Renko chart

Heikin Ashi Chart

Range bars

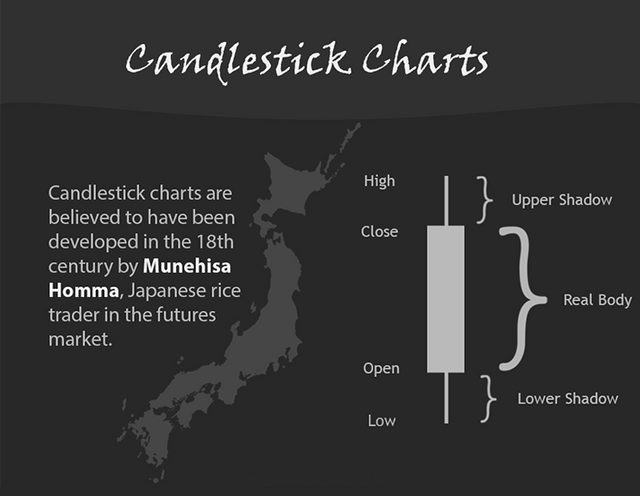

However, candlestick charts are the most popular. Let's see what this is:

Is candlestick trading easier?

This question often arises when one is concerned with the chart, but the answer must be quite clear: No.

Candlestick trading is not easy. The Candlesticks are just visually appealing compared to bar charts for most traders. And the candlesticks look "more modern" because they are "beautifully colorful".

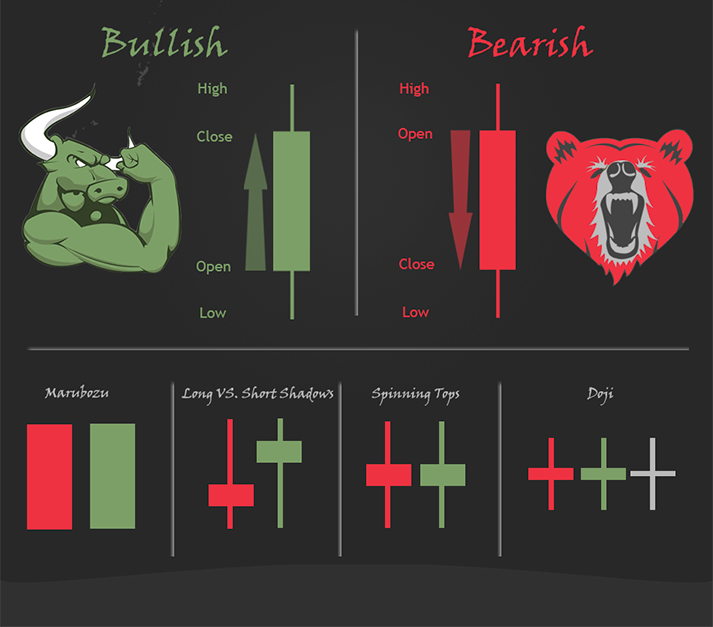

Each chart can ultimately only represent what has happened in the market. Essentially, for each time unit, e.g. Daychart, weekchart or intradaychart, the following four values:

The course for the opening of trade (open)

The course for trade close (close)

The high (high)

The low (low)

While candlesticks and bar charts use these four values to represent the course development, the line chart and point and figure. Chart are usually only shown at the closing price of each time unit.

The candlestick trading in the chart context

The candlecharts bring many well-known chart formations with them. Some of them are:

Doji Candlesticks

hammer

Hanging Man

Harami

Shooting Star

Dark Cloud Cover

and many more…

All of these Candlestick Chartformations do not in themselves have any advantage in trading.

There are, unfortunately, no chart patterns at candlestick trading, which could produce profits reliably. Do not be fooled. A candlestick pattern must always be placed within the context of the overall market movement. Then one can ask the question whether the trading of a Candlestick-Chartformation could make sense.

The difference between candle charts and bar charts.

Even though I'm currently working on Candlestick charts, it does not always have to stay that way. The bar charts are also a good tool in their sobriety. Very often, I also switch between these two chart types.

The main difference between candle and bar charts is the following: The bar charts emphasize the movement between high and low, while the candle charts emphasize the trade range between opening and closing rates through the thicker "body".

Conclusion: The chart type chosen by the trader is only a small part of the trader toolbox. See what chart you like best. For myself, it is the bar chart and the candle chart.

Enjoyed reading your post,

Thank you, i appreciate it!

Good Post!

Excellent post Interesting .. @tradewonk