BlackRock Flip Grayscale In Digital Asset Dominance

In a striking shift within the cryptocurrency investment landscape, BlackRock has swiftly overtaken Grayscale, showcasing a remarkable turnaround in just a few months. Here's a detailed look at how BlackRock has achieved this rapid rise and what it means for the crypto market.

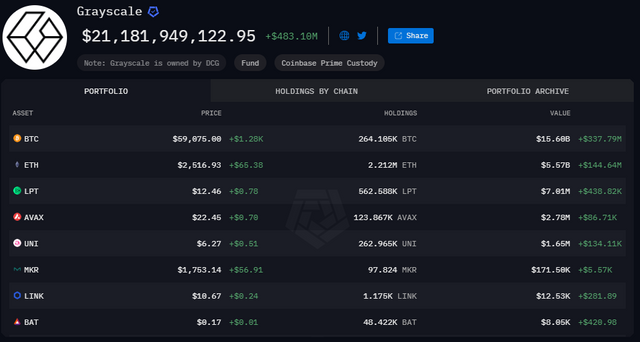

Grayscale's Decline

Peak Holdings: Grayscale's assets under management (AUM) soared to $59 billion in 2021.

Current Holdings: As of September 3, 2024, Grayscale's AUM stands at approximately $20.7 billion.

Bitcoin Holdings: 264,105 BTC ($15.60 billion)

Ethereum Holdings: 2.212 million ETH ($5.57 billion)

Ownership: Grayscale is owned by Digital Currency Group (DCG) and uses Coinbase Prime Custody for asset storage.

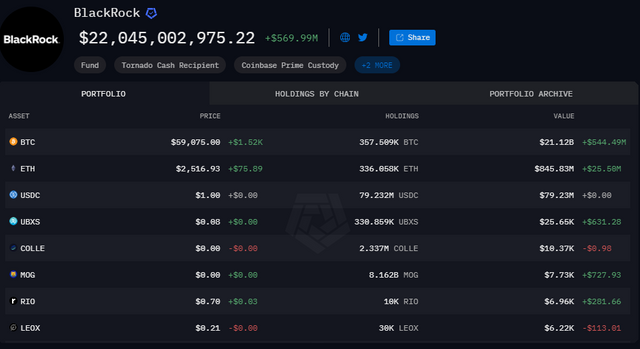

BlackRock's Ascendancy

Start of Year Holdings: BlackRock entered the crypto market in January 2024 with $0 in assets.

Current Holdings: As of September 3, 2024, BlackRock's AUM has surged to $22.05 billion.

Bitcoin Holdings: 357,509 BTC ($21.12 billion)

Ethereum Holdings: 336,058 ETH ($845.83 million)

-Custody: BlackRock also utilizes Coinbase Prime Custody, along with other custodians.

Market Impact and Trends

Market Share: Both BlackRock and Grayscale ETFs now hold approximately 3% of the circulating Bitcoin supply.

Inflow vs. Outflow: Over the past three months, BlackRock’s inflows have significantly outpaced Grayscale’s outflows.

Traditional Firms’ Footprint: BlackRock's rapid growth signifies an increasing footprint of traditional financial firms in the digital asset industry, reflecting a renewed confidence in crypto from major money managers.

Expert Insights

- Lauren Fischer from Grace Capital Management noted, “We may be seeing the beginning of a changing of the guard. These firms don’t want to leave money on the table.”

The Changing Landscape

The swift rise of BlackRock and the decline of Grayscale underscore a transformative period in the crypto investment sector. While Grayscale's decline from a peak of $59 billion to $20.7 billion raises questions about its future, BlackRock's ascent from zero to $22.05 billion highlights the evolving dynamics of crypto investments.

For investors feeling uncertain about the market, the ongoing investments by financial giants like BlackRock serve as a reminder of the continued interest and potential within the digital asset space. As the market continues to develop, the shift in dominance from Grayscale to BlackRock may well be just the beginning of broader changes in the industry.

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

"Loving this detailed analysis! 😊 It's fascinating to see BlackRock's rapid rise in the crypto market and how it's impacting Grayscale. I'm curious to hear from our fellow investors - what do you think is driving this shift? 🤔 And great point about traditional firms increasing their footprint in the digital asset industry. What are your thoughts on the future of crypto investments? 💬

Also, don't forget to vote for @xpilar.witness at https://steemitwallet.com/~witnesses and help support our ecosystem's growth! 👍"