My Approach to Acquiring EOS Tokens

By now you should've read a good amount of stuff about EOS and thinking if you should get some. I'm getting some for sure since one of the engineers behind EOS is none other than Dan Larimer. This is his third major project since BitShares and Steem, so it's a no-brainer for me especially after finding out that EOS is a blockchain operating system. It's something that could be massively scalable and easy for developers to build stuff on it.

So I've spent the past couple of weeks figuring out my approach to get the most cheap EOS tokens as possible, quickly realising there's no way to determine if the price is okay from one day to the next with its pro-rated distribution mechanism. That means the number of EOS tokens that you will get is determined by:-

(Your ether contribution) x (Total tokens available) / (Total ether contributed)

*in a specific time window

In this case, there's just no way for anyone to set a price to purchase EOS tokens during the year-long crowdsale. For example, if I think that a fair price for EOS token is at $1.00 per token, how do I even begin to do this since the distribution mechanism is based on the total contribution made by other people that I have no control of? There is just no way to specify an acceptable price, even with something like buyWithLimit() or some other max price mechanism - please correct me if I'm wrong about this. The only real way to do this is to contribute in the last minute in any of the time windows after knowing how much others have contributed throughout the time window. We all know that may not work very well, especially if the network is congested, or if some other whales contribute around the same time, blowing my fair price out of the water.

In addition, the only currency to get EOS tokens is by contributing ether, and I do not have much of it left. This would mean that in order to maximise my chances of acquiring "cheap" EOS tokens, I would need to consider spending as little as possible to acquire more ether from my diversified stash of cryptocurrencies. So in this case, which currencies do I expect to perform way better than ether in the near future, or more pedantically, before the yearlong crowdsale ends? This is a matter of speculation and patience then.

For one, I think Steem's price will outperform most tokens in the market towards the end of the year, which is why my broad-stroked strategy is simply to keep building on Steem to improve its value just so I can purchase as many ethers as possible with as little Steem as possible. Another maturing technology that might outperform ether this year is Lisk (basically a Javascript couterpart). Maybe BitShares too, since centralised exchanges are getting pretty frustrating to use these days. There are plenty of other tokens that may provide anyone of us with the leverage throughout the yearlong crowdsale, so instead of jumping into the hype now, it's probably best to just chill out at the moment. But of course, FOMO can still be a good thing, so my approach is to buy with whatever ethers I have left in the first 5 days, and then just be patient throughout the rest of the year, buying more only when I can leverage off my other cryptocurrency holdings if they end up outperforming ether by a long mile.

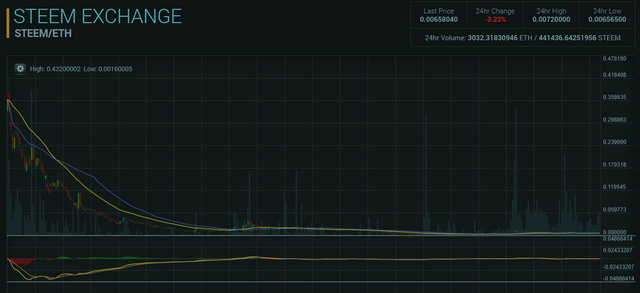

See for yourself - Steem / Eth and Lisk / Eth long-term charts:-

I really can't believe it for myself whenever I see this chart. Don't get me wrong, I'm a huge Ethereum fanboy, but this kind of graph just does not justify my frequent activity on the Steem network. I don't even find myself using any Ethereum apps except for the ICOs. I think many of us can relate to this observation. Plus if you consider the more elusive stuff like chart logic and market correction, it would seem like Steem is due for a massive uptake, finding a market retracement from the huge downtrend.

Lisk is like a Javascript-based Ethereum, so it may attract plenty of mainstream developers. Plenty of stuff can happen just from this little fact alone, barring core developer competency and all of that. Some have said this could be the dark horse of the year, so it would be great to be able to leverage off its massive uptake for EOS when that happens.

Conclusion

Please don't take any of these as serious advice because I'm just explaining my approach here. We all have our own different preferences, and what works for someone may not work for anyone else at all. So far, the only thing that has worked extremely well for me is patience. All the best in getting your EOS tokens!

Like any investment, don't put in more than you're willing to lose 100% of.

That said, there are three "good" approaches

Buy what you can afford during the ICO "auction" and get what you get.

Benefits include being an "early adopter", growing the platform, participating in initial value. Drawbacks include potentially getting a worthless product, potentially owning over inflated coin.

Buy immediately after the ICO. Benefits include buying at a "known" price, getting a product that actually exists, still being an early adopter. Drawbacks include, value can always still decrease, the project could still "crash" losing all value.

Set a tolerance limit buy order after the issue to buy during the first "panic sale". There will be a panic sale, it's a crypto and market makers will make sure there's at least one panic sale. Risks and rewards are the same as 2, but you may buy in at an extreme low.

I'll skip this, although it's a good project. I simply don't like to enter the same door as thousands of others. Plus I've tried to buy BAT token and spent almost $100 on commission with no luck. It was my the first and the last attempt with ICOs. :)

So you have been bitten by the quircks of the Ethereum network. All these ICOs have proven the need for a more capable system with better cost prediction and transaction output. Ironically EOS, the system thats supposed to have solutions for this, may break Ethereum.

I hope, but I'd like to wait for some time. If EOS will go well, I will buy in a depression period.

Smart thing to do, since there's that hype / shitcoin graph that happens so very often (although ethereum seems to be the one that broke that shitcoin depression thing in the beginning)

EOS tokensale has made everyone take a stance like in the prisoner's dilemma problem. Best approach is to choose a frequency for the next 341 days and buy - the key is no one can predict when the whales would go for it or not.

Yeah I might also consider sending in fractions of eth everyday just to average it out, if that even means anything in this case lol

I think that after the appearance on the stock exchanges, the price will drop slightly.

I also think in the same way when it comes to holding steem tokens for future benefits. According to me If you know that you are going to have a profit in a certain thing then sell off your low potential coins.

Sadly, everytime i sell off what i consider to be low potential coins, they'll shoot for the moon a few days after :P lol

LoLx, Likewise but most of the time they follow my commands.

I am getting very sketchy with the way these ETH ICOS are bought with no dash board and hope you send ether with enough gas or your transaction fails.

What a SurpRISE !! - ))

.. YOU are 'oNe' of a KinD !! - ))

i hope YOU don't mind ?? - ))

.. but, this feels so MUCH like .. - )))

ha ha ... in such a FUN BeautifuL WaY !! - ))

.. thanks DaN - ))

LOVELOVELOVE )))

greb'Z )

ps .. i love the EtheR PunK .. just a synchronicity - ))

... or, is tHERE .. such thinG as .. coincidence ?? - ))

ha ha )))

So it means that new comers like me who want to invest little money into crypto space should wait and see, well my approach to things is like this, if you can grab it at an early stage then you might get benefit at a later stage, its like take a risk and get a chance, so i will advise other if you can take a risk then you might get a chance in the near future and this is what i think i am gonna do with EOS @kevinwong

There is a few ICO's i have not lost yet, but these ETHER icos i would rather wait till a dump on the market after first few days

Yeah, no brainer if I had some Ether left. Dumped mine last week and not willing to cash out any steem power. I'll have to live vicariously through you! Good luck and keep posted!

So far, Steem has been proving itself to be an excellent product, so probably no lost there. Hard to say much though - the crypto space is just too unpredictable for anyone..

Sorry I can't give back as much as you can give.......one day I will be able to.......one day. :) you're my inspiration buddy

Buying everyday for the same amount means buying average. So i will divide my investment by 365 and buy at the end of the day for that amount. I just want EOS for a reasonable price and this is unpredictable crowdsale. When buying this way, i could skip some crazy hyped prices at the end of the year. If the prices will not be hyped though i am gonna buy more. I think the price won't change very much from day to day, but the price difference between first day and 9 month could be huge.

Seems like a decent strategy if we can schedule it easily without hiccups. I wish there's a day when everybody forgot about EOS, and I'm the only one sending in 0.1 eth for that ~2,000,000 EOS lol

Haha :D you made me laugh. But that is actually a serious issue that EOS crowdsale will need to face, i didn't think about it before, but there might be a lot of the DDOS attacks on the crowdsale and also Ethereum network might be seriously congested. It's gonna be fun :D.

Thanks for putting your thoughts out there. It's really helpful for someone like me who cant grasp the concepts yet.

I believe in EOS and plan to put some money in it. My strategy is based on volatility of new cryptocurrencies. It turned out that in first weeks (maybe a month) price of every currency has a great oscilations. Almost always it goes up and than crushes (see for example MIOTA). So I plan to catch the moment and buy it.

That should work 99% of the time.. and only if you're there at the moment..

Agree. I am aware of risks but that is a beauty of crypto trading. When we see that something is happenig, one member of our team stays awake. Also, we transfer resources to exchange and than wait.

I agree, if the distribution mechanism is based on a contribution made by other people i'm not sure either what is going to happen. But still worth a shot.. with some left floating crypto.

It's hard not to take you seriously when you think exactly the way i'm thinking about it lol

Thanks for your hard work man :-)