DeFi momentum accelerates

As interest in crypto yield farming surges, DeFi has achieved another major milestone this week with a total of $2B now locked in the Ethereum ecosystem - with industry experts noting that growth in DeFi is turning Ethereum into a type of ‘money whirlpool’.

In another big week for Ethereum news, the value of funds locked in the DeFi ecosystem has surged to over two billion dollars, according to DeFi Pulse. The milestone comes after the value of locked assets in DeFi crossed $1B in February of this year. In March, when all financial markets crashed as the pandemic spread, the value dropped to $533,000. After a steady climb back to $1B, in the last three weeks the rapidly growing interest in DeFi triggered the surge to $2B as crypto traders and investors embraced the new ‘yield farming’ phenomenon.

Yield farming or liquidity mining is an incentive mechanism used by DeFi protocols to attract liquidity. The protocols achieve this by issuing tokens that represent network governance rights for those that bring liquidity to the network. The biggest example of liquidity mining is Compound Finance. After the release of the protocol’s COMP token, the protocol’s market cap surged to almost $650M. In 2020, DeFi coins have been some of the best-performing assets in the crypto market.

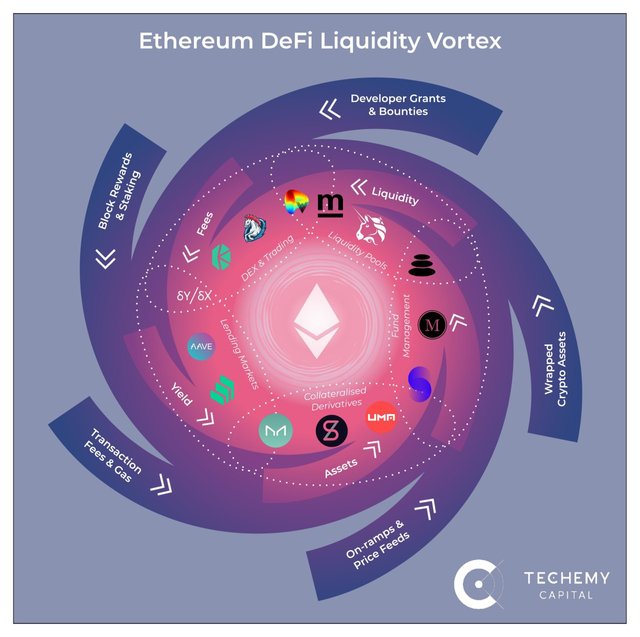

According to the team at Techemy Capital, the growing interest in Ethereum, DeFi, and liquidity mining is due to a phenomenon called the ‘Ethereum DeFi Liquidity Vortex’. To visualize this thesis, and show how Ethereum attracts assets via the various DeFi protocols, Paul Salisbury, crypto-economic Analyst at Techemy Capital, created the following visual:

Source: Paul Salisbury Twitter

https://twitter.com/paulsalis/status/1278920299136741378

We often see ecosystem maps cluttered with logos, however, the vortex illustration is uniquely useful for its ability to convey the interconnected nature of DeFi.

Salisbury says the visual illustrates the crypto-economic inputs that are driving the growth of the DeFi ecosystem, as well as the five overlapping classes within DeFi. "It starts with the outer vortex of Ethereum, where the protocol incentives have combined with the ecosystem growth of the past five years thanks to the momentum provided by developers."

Salisbury adds that the inner vortex of DeFi started to accelerate once there was a nexus of Collateralised Derivatives, Lending Markets, DEXs, Fund Management, and Liquidity Pools. “Perhaps most interesting is where permissionless innovation and composability has allowed for cross-overs between categories,” he says.

It is a point that Anthony Sassano, Product Marketing Manager at Set Labs / TokenSets, and a long term Ethereum contributor, continues to make. Writing on Substack Sassano says that as the DeFi liquidity vortex accelerates, Ethereum is on track to consume all assets, financial or otherwise, inside and outside of crypto.

“In the financial world, there is a saying that ‘liquidity begets liquidity’. What this means is that as more liquidity is added to a market, it attracts more users who add more liquidity, which then attracts even more users who add further liquidity. This quickly snowballs and becomes a self-perpetuating cycle,” he says..

While most commentators are focused on DeFi’s surge to $2B, an interesting subplot is that during the last few weeks, approximately 6200 BTC (~$55 million) has migrated to the Ethereum DeFi ecosystem according to data by BTC on Ethereum.

Sassano says that this idea of liquidity attracting liquidity is exactly what Salisbury’s vortex visual shows. Why is Ethereum attracting this influx in capital and liquidity? “It’s because when assets are migrated to Ethereum, they get supercharged and they become programmable,” explains Sassano. “BTC on the Bitcoin network is what I like to call a ‘pet rock’ - you can’t do much with it. However, holders who bring BTC to Ethereum can get access to the entire DeFi suite. For example, you can put your WBTC, renBTC, or sBTC into a Curve pool to farm SNX, REN, CRV, and BAL. This is ‘yield farming’ to the extreme and it obviously won’t last forever but doing this sort of thing, or earning this kind of yield on Bitcoin is just not possible. BTC is just one of many assets that Ethereum will suck into its gravity well over the coming years.”

https://techemy.capital/

https://www.tokensets.com/trader/TechemyCapital

https://thedailygwei.substack.com/p/the-ethereum-defi-liquidity-vortex