DEEP DIVE INTO MINING - Hosted Mining (Giga-Watt Review) / Cloud Mining (Genesis) / Self Hosted Mining

Over the last month, my coworkers have been on a mission to find every different type of graphics card to mine alt coins. The hot ticket card has been MSI Gaming GeForce GTX 1070 8GB. They have made custom built cases to build their mining unit to house 6 cards similar to this mining rig found here. The site estimates you can make $1,000 per month on a rig depending on hash rates and performance.

I've been following @dafamousdj on Cryptocurrency Edutainment and loved the episode on Genesis mining calculation shows it is not profitable due to needing referrals to keep up with the hash rate. I've heard a lot of negative reviews on Genesis mining on top of @dafamousdj video. Genesis mining did offer a Response from Genesis mining in regards to the profitability of mining DASH.

In my discussions with a fellow crypto friend @mada he mentioned the difficulty of mining due to power requirements. Which only made my ears perk more when @dafamousdj had an episode on the new token from Giga-watt for mining ETH, BTC, & LTC - Bitcoin & Ethereum mining: cheapest costs? $0.033 KwH and less. The token currently available for $1.05 on Cryptonomos until June 30th at 12 PDT and then will increase to $1.20 until the ICO is done.

Each token represents 1 Watt's worth of the processing center’s capacity. That equals out to $0.033 KwH which includes maintenance and electricity. $.033 KwH is impressive given the current local electricity cooperative rates range between $ 0.1189 - $0.1289 depending on the time of year. This makes this token very appealing compared to Genesis Mining based on @dafamousdj video and Home mining. The installation is covered if you buy the miner from Giga-watt which all but the LTC unit have been instantly sold out.

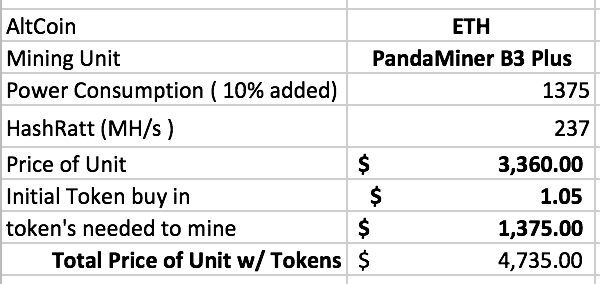

GIGAWATT Costs

To mine with Giga-watt you have to have a token for each watt needed for you mining unit. You may rent your tokens out to other miners if you choose to not use your tokens or have excess tokens. The token is said to be available on the exchange once issued. It was confirmed on Telegram that you could transfer your tokens to someone else. If you want to get your mining unit faster than they can provide you can buy your own mining unit and have them install a ASIC miner for $20 and a GPU miner for $40. Their CEO David Carlson mentioned having the capability of fixing your unit on site for:

- Repair of one blade: $100

- Repair of the control board: $100

- Repair of mechanical elements: $50

"Right now Giga Watt uses Slush Pool to mine bitcoins, NanoPool for Ethereum and LitecoinPool for LTC. But in the future the list of pools may grow." Each pool has a 1% fee.

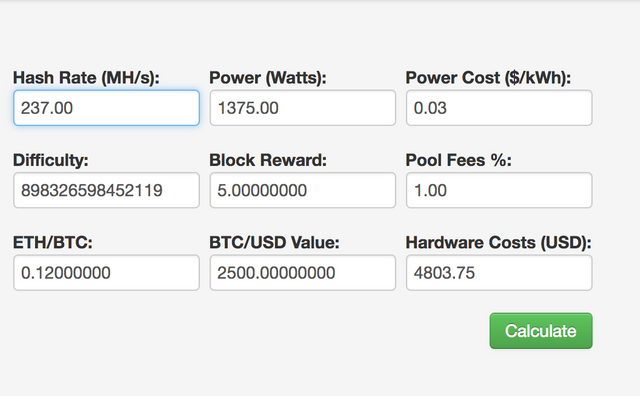

I ran the numbers based on the PandaMiner B3 Plus which they previously had on their site. You can see the ETH profitability for yourself here.

I included the price of the tokens in the analysis primarily because the rental of the tokens is unknown and not yet on market. I have not included any repairs. Feel free to run the numbers and give me feedback.

I found out that the Telegram account is managed by Cryptonomos and doesn't have data for average repairs per unit yearly. Responses on Telegram ranged from who knows to mining units last up to 2.5 years from other users who were not from Giga-watt . What exactly does repairing a blade, control board, and mechanical elements mean? What can go wrong with a mining unit?

What's the worst that can happen with a Mining Unit??

I was really interested in the PandaMiner B3 Plus to mine ETH which was sold out on Giga-watt. I began my search to buy one on the market until I found this youtube video, Why you should NEVER buy a Pandaminer B1 B3+ Review - Caught FIRE!. The video not only mentioned the miner catching fire, it also shed light on another issue, the need to upgrade a driver due to Windows 10 auto updating. This left the miner with a worthless unit. The miner revealed that PandaMiner's support was far below expectations and they even shipped him an instruction manual written in Mandarin. I was told on Telegram that Giga-watt maintained the firmware included in the $0.033 KwH maintenance and electricity. This was great to hear. I was referred to support@giga-watt.com when asking detailed questions on Telegram like what happens when my unit catches fire, how many units have caught fire, and what are typical repairs? Support at Giga-watt responded via email that no PandaMiner B3 Plus units have caught fire.

Mining Facility of Mining Fort Knox

You have to ask the question, how are these mining facilities protected? How will they prevent a Denial of Service Attack (DDOS) which Kraken, Coinbase, and every major site have fallen victim to? Who has access to these mining facilities? DataCenters gain the trust of their clients by being SOC Compliant. What are the compliance regulations for these mining facilities? People relate bitcoin to the gold rush. With gold you can lock it behind an air tight vault allowing no one access until you wanted to get the gold. However, mining needs to be available for block chain. A highly concentrated mining facility would be a perfect target to manipulate the market. What is the backup recovery plan when the mining facility get's the next malware attack? Are the mining facilities A/C units firmware being patched? How prepared are they for Mr. Robot? Giga-watt was able to comment that they do have measures in store for DDOS but couldn't elaborate. There was no reply on any other security measures incorporated.

Mining with Giga-Watt - What are you banking on?

The biggest thing you're banking on with Giga-watt is the market, their ability to mine coins other then BTC, ETH, and LTC in the long term, and the little details left out of the White Paper. It doesn't seem as though you'll be able to start mining until September unless you purchase your own mining unit. Do you believe in the cryptocurrency market staying profitable for the next year while Giga-watt's get units in stock, Giga-watt's ability to help your mining adopt with forks, and you as a miner won't be responsible for unpredicted circumstances of mining other then just repairs?

What's the market saying lately?

Everywhere you turn you hear CryptoBubble. Ameer Rosic recently had @blockshow as a guest ICO bubble Madness: Addy Crezee articulated that the burst will happen because of ICO's failure to produce results. In Ameer's episode Cryptocurrency Market Hype or Not? the speculation was the bubble will burst a year so before the market corrects. This is all speculation and who knows what Segwit/hard fork may do to Bitcon, Metropolis and Casper for Ethereum, or what EOS will bring to the table. Has the cryptocurrency market found enough investors to withstand the ICO wannabes? David Carlson displayed confidence and in depth knowledge on mining. The facility is available for touring. Giga-watt's white paper has milestones and the ICO has sold over 12 million tokens.

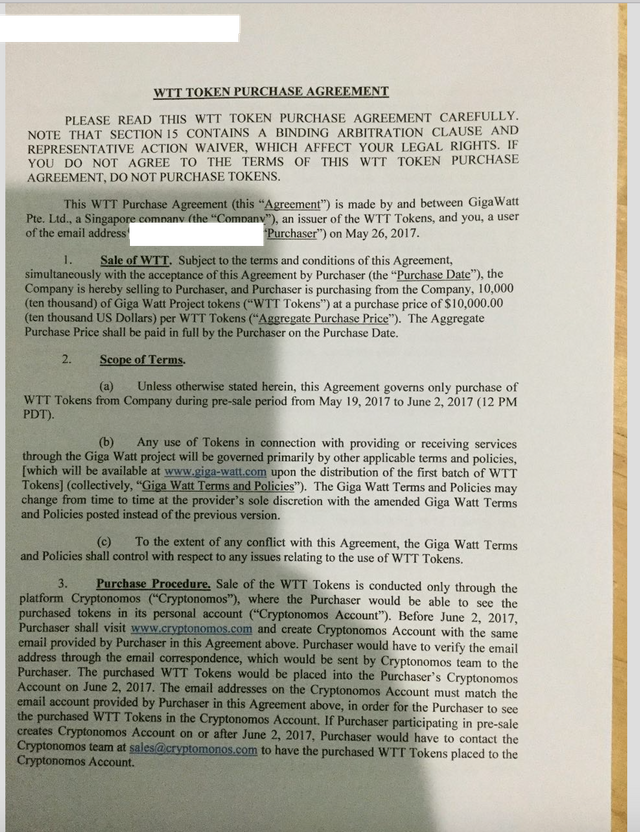

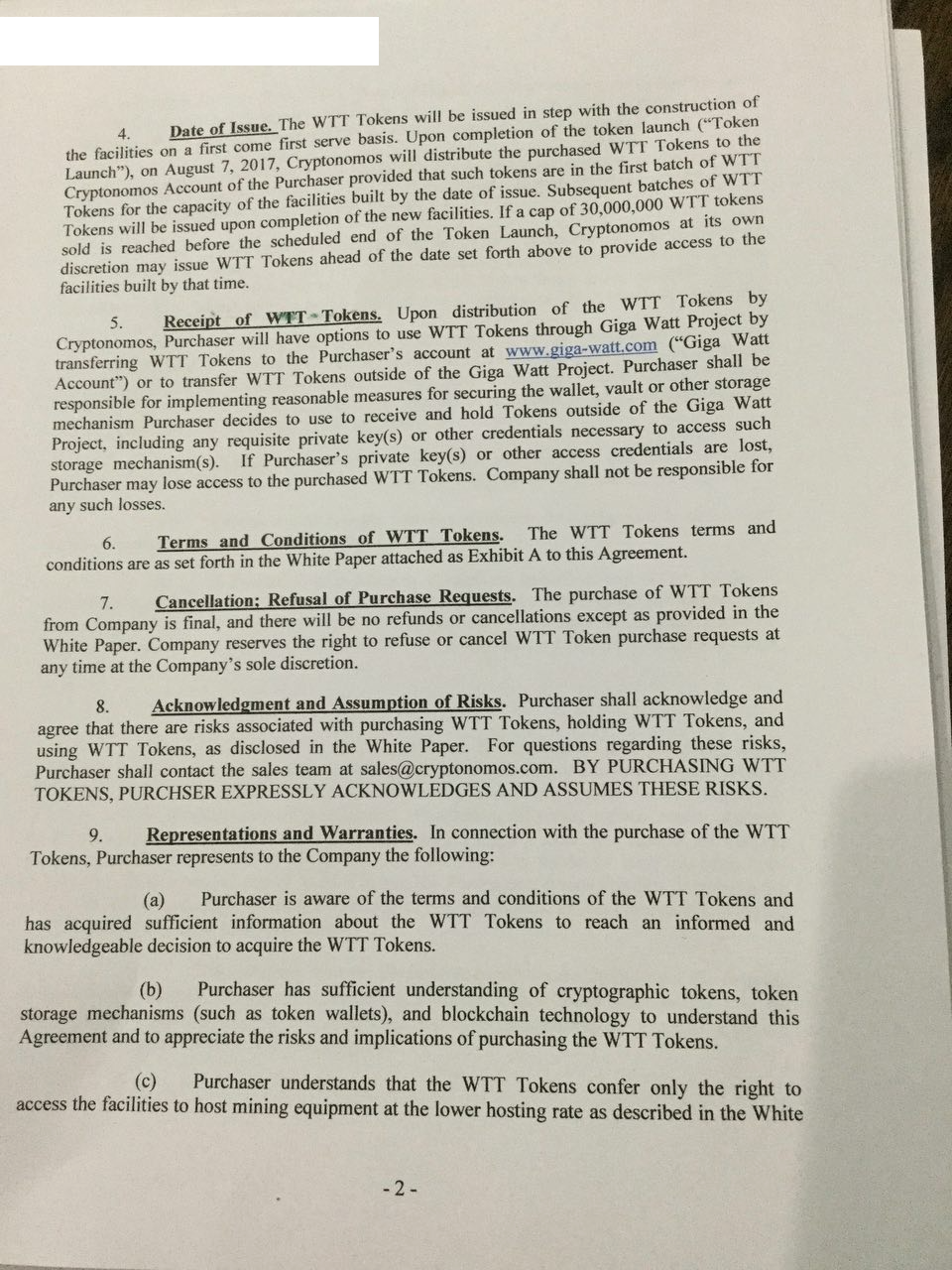

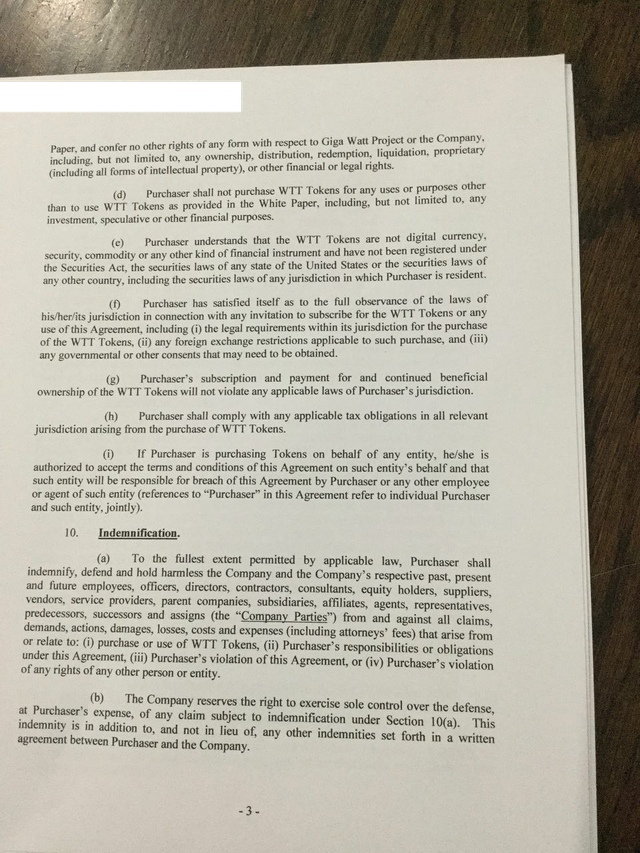

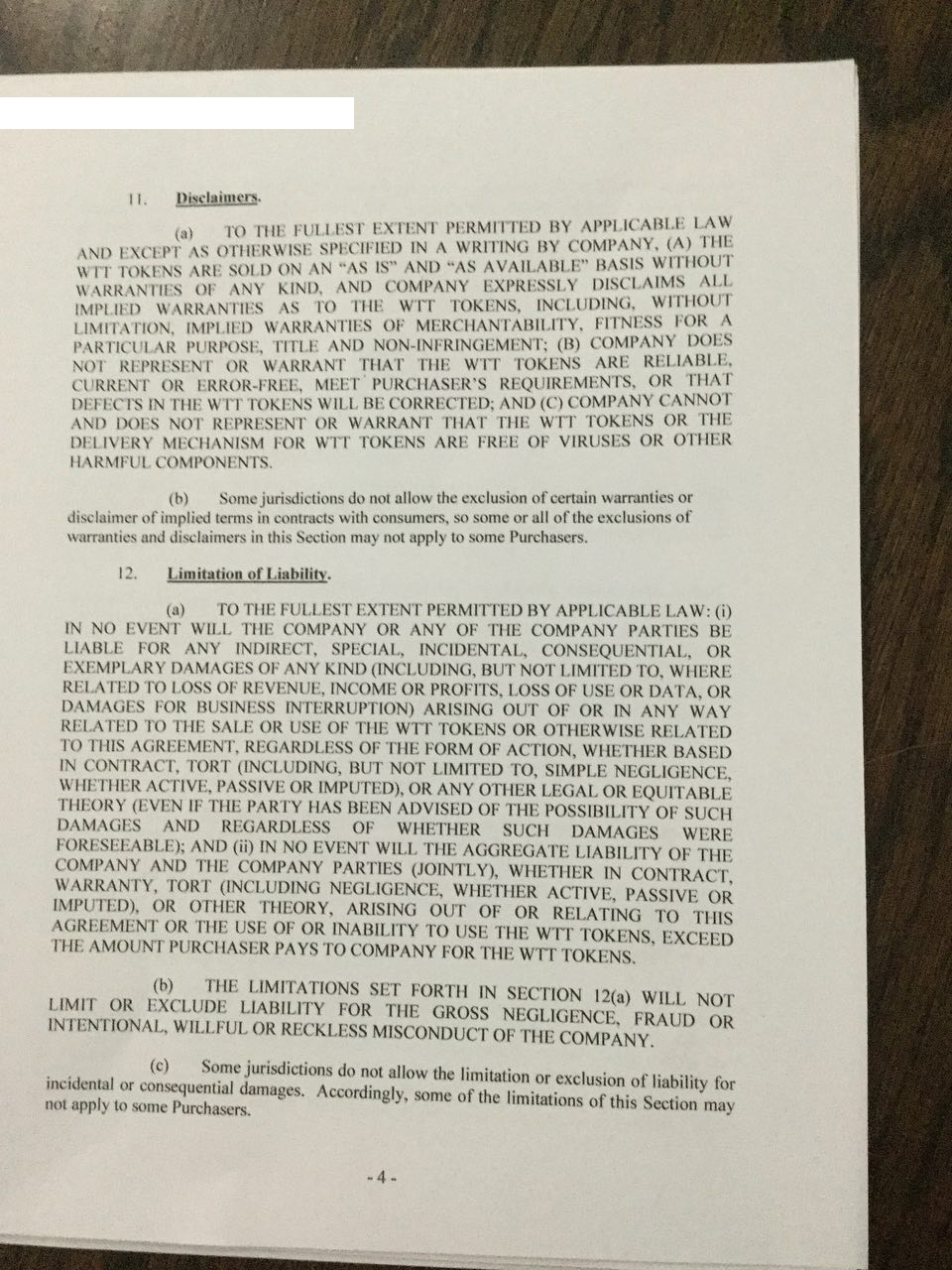

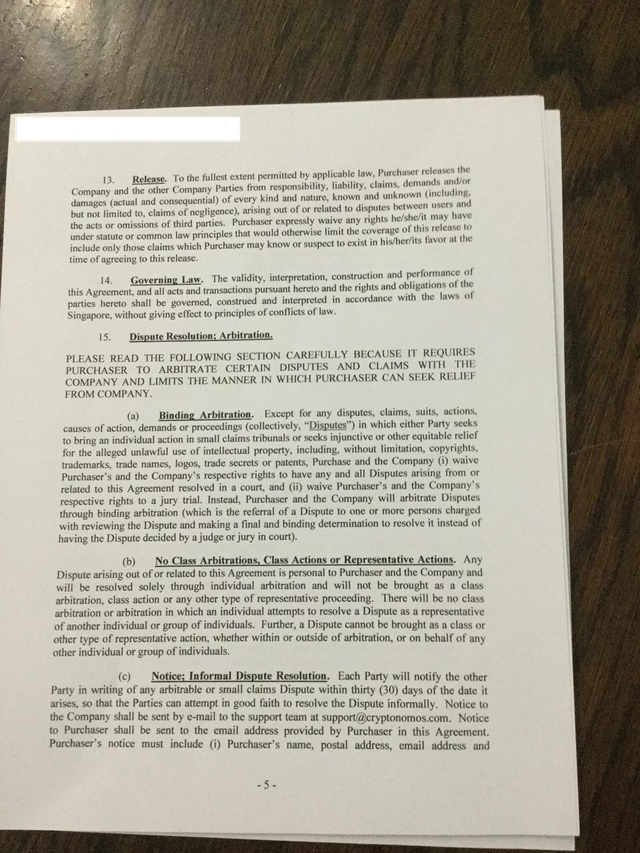

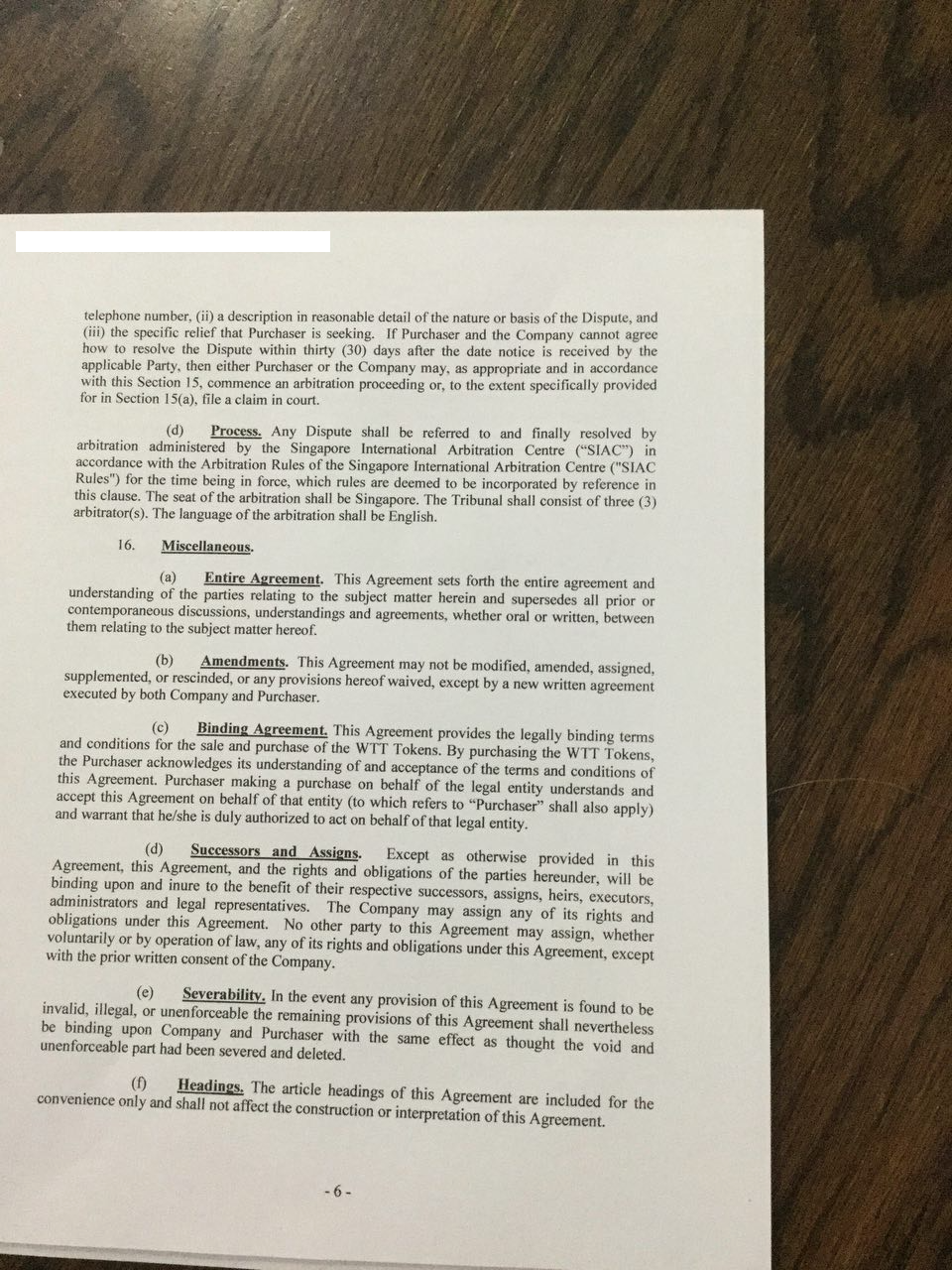

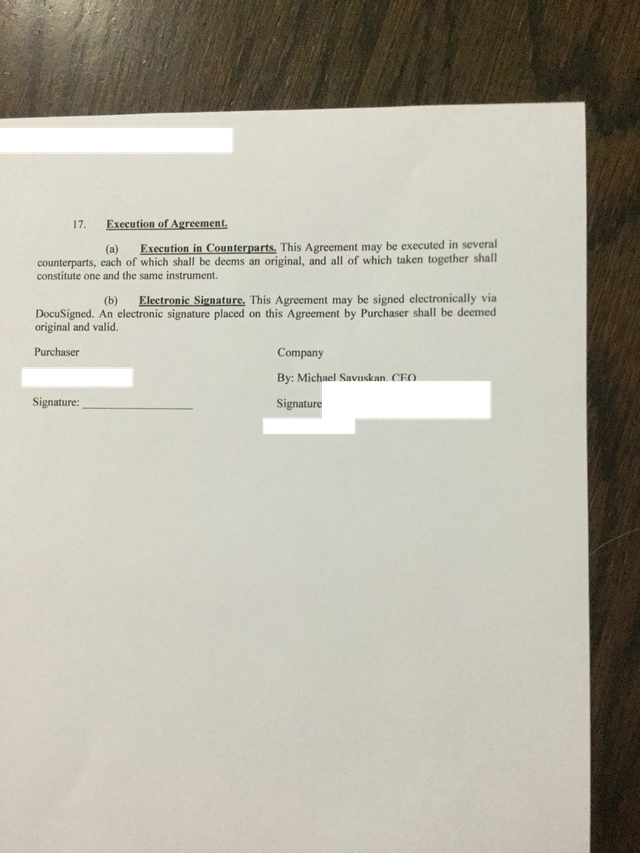

Giga-Watt Token Contract

The white paper does not elaborate on the security portion that a major miner would expect and need. I was curious to see what the contract would state in regards to liability of mining units and mining facility. I was able to get ahold of one here:

My interpretation is that you're basically buying the tokens based on the White Paper. Nothing more nothing less. My biggest concern about Giga-watt is compliance of the facility, security of the mining units, and the liability of owning a mining unit in their facility with other mining units. All of those answers have not been addressed in their white paper, contracts, or discussions with support. What are your thoughts? If I get enough traction I will tour Giga-watt next.

* Disclaimer – the above is not investment advice, do your own risk assessment. I'm not an attorney. Feel free to provide feedback.

Thanks for the in-dept post! Finally real information about this subject backed by calculations and research. Not just to catch commissions. Upvoted!

Thanks @michiel I will update more when I hear back from Giga-Watt as well.

Followed you because I am interesting in your next post about this subject. I bought Giga-Watt tokens about a week ago, but can't log in properly because the message of the 2FA comes a few hours to late every time (I think not Gigawatt service but a 3rd party?). It is annoying but just a small technical issue, I guess it will be resolved soon, didn't undertake action yet

followed, follow back?

Any one else remember GigaOm?

@denno, very nice post! And happy to see that I have been part of you research :)

finally a steemian who is knowledgable about mining! im think about buying a graphics card for mining for my gaming pc, good post, followed

Great post! I'm a newbie in this space and these kind of posts help immensely to understand it better. I came across the giga watt ICO and could be interested in the renting out options. Trying to do some calculations on that...which is not easy! This might be a bit of a long shot but do you happen to know or point me to someone that knows the current and projected size of the mining space? I understand that this is not exact science by any stretch of the imagination, just trying to wrap my brain around the opportunity here. Thanks in advance!

great Post and for newbies on mining: https://minergate.com/a/f61611b1710b38ec861ea4cc