Monkey Capital, disrupting Blockchain and Venture Capital

What's this about?

In the following years of the .com bubble, a lot of internet companies started to go downwards, with the last big Company to surface being Facebook. We've had Uber, but with the latest management problems, that's not looking to good. Then we have Snapchat being unable to generate profits, while actively losing over $500M in 2016 alone. And while Facebook's decision to copy Snapchat's Story option into Instagram and WhatsApp, might not have been very ethical, it is definitely giving the young founder quite the headache.

Of course, even with all of this, there have been succesful internet unicorns, but none of them came close to the resounding success that Microsoft, Google, Apple or Facebook had. So the question is, what comes next?

One thing we do know, is that for a business to enjoy such success, that business needs to disrupt the industry in which they are in through ground-breaking innovation, so today, the focus will be on Monkey Capital, an upcoming ICO that plans to disrupt two industries at once, Blockchain and Venture Capital.

Monkey Capital

Monkey Capital describes itself as a decentralized Hedge Fund, but what does that actually mean? Well, first of all, it means that the money from the public fundraisers(ICO) will be invested in various business opportunities, and the dividends will then be shared with Token Holders. Monkey Capital is backed by three other companies: DMH&CO, DX Markets and LOUD Capital.

DMH&CO is a business with more than 250 years of existence. While the company has had significant changes over time, both in name and activity, this proves one of Warren Buffet's most important Business Tenets, namely: "Does the company have consistent operating history?" And while Monkey Capital itself does not, the companies behind it do.

DX Markets develops blockchain and digital-assets technology, they implement blockchain technology in enterprise software and Marcelo, the CEO of DX Markets is one of the leading blockchain developers.

LOUD Capital invests in disruptive high-tech companies such as Hyperion, a company which is currently building the first hydrogen powered car, Nikola Labs which aims to bring us wireless power. They also invest in software companies like Hansya which is targeted at Digital Marketing professionals, or Seamless AI in order to bring artificial intelligence and the advantages of machine learning to mainstream things. And I haven't even mentioned Bylined, an app that wants to transform everyone into a photographer, allowing brands to get to get feedback in real time from real people.

These are just some of the companies they will be investing in. Their other companies are from domains such as aerospace, high-tech production hardware, genetics, robotics, software and healthcare.

The People Behind the Product

Daniel M. Harrison is the CEO of Monkey Capital and the CEO of DMH&Co, besides having predicted Bitcoin's price 3 years ago with less than 10% error, he is also an Oxford educated Journalist. One of the articles I would recommend is the one about a possible shared economy, entitled "The Wealth of Corporations". After getting to talk with him in the slack channel, the first thing that is easy to notice is his brutal honesty.

Marcelo Garcia-Casil is one of the main tech guys behind the project, being one of the leading blockchain developers in the industry and having founded Maecenas, a fine art investment platform and DX Markets which handles the integration of blockchain technology in enterprise processes. Before this he worked as a Developer at major banks such as Barclays, National Australia Bank and Credit Suisse

Darshan Vyas is one of the Managing Partners and Co-founder of LOUD Capital, a successful entrepreneur in the healthcare industry, he now focuses his attention in finding ground-breaking innovations and companies. LOUD Capital and Monkey Capital are holding regular calls on Monday, Wednesday, and Friday at 10 am EST in order to discuss the value that the investments will be bringing.

Navin Goyal is an anesthesiologist by profession, but besides working as a Doctor for over 10 years, along with Darshan, he is the Co-founder and Managing Partner of LOUD Capital. Before LOUD Capital, he has successfully founded SmileMD and also acted as an Advisor for Endeavor Forward.

Seth Shapiro is a Two-time Emmy® Award winner. His clients include The Walt Disney Company, Comcast, DIRECTV, Intel, IPG, NBC, Showtime, RTL, SBS, Universal, Slamdance Studios, and Goldman Sachs. He is a Governor of the Television Academy, and sits on its Executive Committee

Peerchemist is one of the most knowledgeable people in regards to blockchain, having invented the digital asset protocol called PeerAssets and leading the Peercoin project, the first ever Proof of Stake digital asset in the world.

The Tech - How Does it Work?

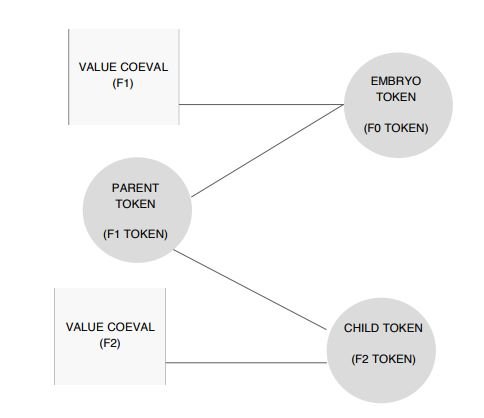

Monkey Capital is a Value Coeval. A Value Coeval is simply put, an investment focused group. It is some times associated with a DAO, but there are some key differences, the most important ones being the fact that a Value Coeval, by it's very definition is built to protect investor's money. And while a DAO is somewhat ambiguous, a Value Coeval is well defined as a Partnership Agreement Structure.

Now, if we were to define a Value Coeval as a process, as opposed to a structure, we would arrive at the following three Token Families:

1)Embryo Token - A Token placed on the market prior to the ICO for establishing pre-market liquidity, dividends will be paid through the Embryo Token

2)Parent Token - A token that is emitted at ICO which carries multiple other tokens inside, which are called Child Tokens

3)Child Tokens - Specific aspects of the portofolio underlying specific aspects of the Parent Token's portofolio

Now the Embryo Token of Monkey Capital is called Coeval and is a Waves Based Token, and is a pre-sale for the MNY ICO which starts on 8th August. The ICO takes place from 8th August to 9th September and includes a total of 1 Billion MNY with no fixed value, of which 490 Million MNY will be awarded to Coeval owners, and 510 Million will be awarded to ICO contributors. The rate at which Coeval owners receive MNY is 1 Coeval=10.000 MNY with a total of 49.000 Coeval in circulation.

There's something else about this structure that brings value. After the MNY ICO is over, KEY and CAPS will follow. At the end of KEY ICO, a percentage of all KEY will be awarded to MNY Token Holders, while at the end of CAPS ICO, a percentage of CAPS will be granted to MNY Owners andto KEY Owners. Besides this, a percentage of the total sum raised in KEY ICO will be used to buy up MNY off the Market, and then a percentage of the total sum raised by CAPS will be used to buy back MNY and KEY off the Market.

What we have to keep in mind now is that Coevals value raises with each consecutive launched Token, because it is the Embryo Token. Besides this, dividends are paid in Coeval by buying Coeval back and redistributing it, and because the supply is limited(49k) as the Revenue of Monkey Capital increases, so does the demand of Coeval, in order to be able to pay the dividends.

Alright, so now you're wondering, what's the catch, why would I buy Coeval now instead of waiting and buying MNY? The current price of 1 Coeval is approximately 0.17 BTC, so with a total of 49,000 Coeval we have a Market Cap of about 8820 BTC or about $20M Dollars, but this is the equivalent of 490M MNY, meaning that the current valuation of the MNY ICO is about $40M Dollars. Now the math is quite simple, if Monkey Capital raises more than this amount, which isn't all that hard if we were the consider the recent ICO's of companies like Status and Bancor, then it means that Coeval's value will increase even further.

Here's a Graph for the past 4 hours

Useful Links

1. Wallet - https://waveswallet.io

2. Website - https://www.monkey.capital/

3. Whitepaper - https://www.monkey.capital/docs/MC_Whitepaper.pdf

4. Slack Channel - https://mkinvites.herokuapp.com/

5. Bounty Campaign - https://bitcointalk.org/index.php?topic=2010103

6. Step-by-Step Guide for purchasing Coeval - https://monkeycapital.slack.com/messages/C5WCGRSCR/files/F6A9TN45S/

Cheers to @khan for making the Guide

its good to invest do you think

I have invested in it, so it's obvious I consider it a good investment, but it is almost always a bad idea to take investment advice from strangers off the internet, so I recommend you read about Monkey Capital, join the slack, ask around, and decide for yourself if it is worth investing or not.

Congratulations @colorlessk! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard!

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes

Congratulations @colorlessk! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!