ETPUSD fundamental analysis: a Star Catcher!

Metaverse fundamental analysis. Growth factors for ETP price. ETPUSD trading scenario. Key levels to trade ETPUSD.

In this post, I applied fundamental analysis and some elements of technical analysis.

Today, I’d like to analyze fundamental factors for a relatively young project Metaverse. Until recently, this project was almost invisible in the market and didn’t stand out from other spam coins, which are at the bottom, below the 30th position by their market cap.

I paid my attention to the coin for a very simple reason. Its price has been steadily going up over a month already, and it is not going to stop, at first sight.

https://hyipi.com/wp-content/uploads/2018/08/dinamiku-Bitcoin-i-Metaverse-na-odnom-grafike..jpg

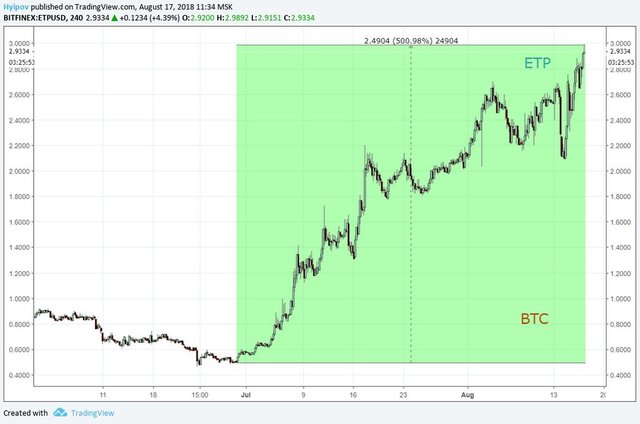

It is especially clear if you compare Bitcoin and Metaverse trends in the same chart

According to the data in the chart above, Metaverse altcoin is growing 3.5 times faster than Bitcoin.

If you judge by absolute values, ETP price has been 500% up since early June. In the chart above, you see ETP grow from 0.5 USD up to 3 USD.

Besides, it is important that the trend is steady. It means strong buyers and continuously increasing demand for the coin. That is, it is not about any pump with a long upward tail, as you usually see in the charts of low-liquidity tokens.

What are the reasons for such demand and what, in fact, the coin is? I’ll try to analyze in more detail.

If you visit Metaverse website, you won’t find anything prominent or exciting or catchy. A usual landing with beautiful ideas about seeking to change the future and make a small revolution on the scale of the Universe.

I suppose, it is because its dullness, hardly anybody paid their attention to the token. If read the information, each second ICO promises a revolution and every one promises to make your life better and easier.

However, I think you should consider what Metaverse team is presenting.

Simply put, those guys decided to include in the blockchain as many functions as possible:

- smart contracts;

- decentralized applications;

- own tokens and crypto assets;

- digital identification and signature;

- cryptocurrency exchange.

And, the most important, at very high speed and almost for free.

Looks really appealing! Doesn’t it?

Now, let’s see what is behind of this miracle’s face.

I failed to find the whitepaper from the first try. They for some reason placed it not on the official mvs.org website, but on a separate domain newmetaverse.org; besides the whitepaper is not single, there are two of them

Of course, I’m not going to retell them here, but I’ll note some factors that can fundamentally affect the rate.

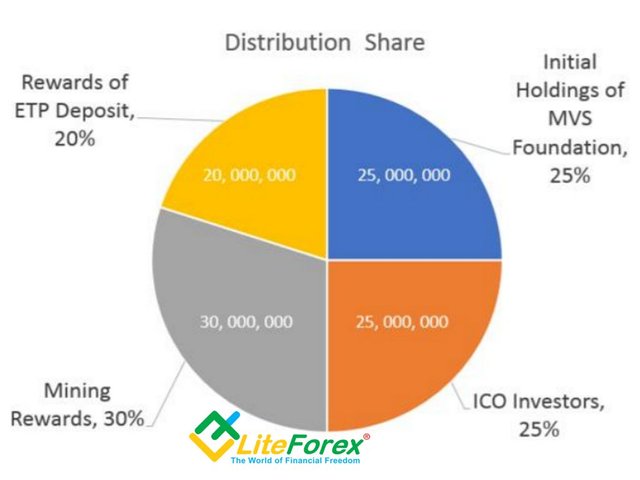

According to the whitepaper, there will be issued 100,000,000 ETP in total. Just 100 million!

In addition, this cake is divided in a very interesting way (see the chart above).

30 million ETP is for POW mining, which now is available with common graphics cards;

20 million ETP is for rewards of ETP deposits;

25 million ETP is for initial holdings of ETP development team;

25 million ETP is for ICO investors.

These facts are the most interesting for me, from a fundamental point of view.

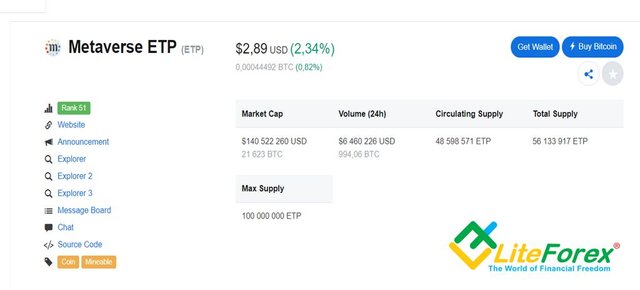

According to Coinmarcetcap, the total circulating amount is 48 598 571 ETP, and total supply is 56 133 917 ETP.

Therefore, 43 866 083 ETP is left to be issued. It the funds, suggested form mining rewards and rewards of deposits. So, I have no reasons to worry that the tokens will dumped into the market all at once.

If you take the freely traded coins out of the total issued amount, you will get the remainder worth 7 535 346 ETP. I can suppose that this amount is held on Metaverse deposits by the project investors themselves and can be used in the market economy in the near future.

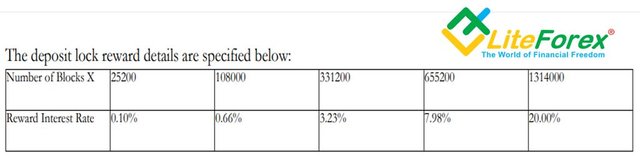

In the table below, you see the reward system of deposits.

The interest rate here is calculated according to the number of blocks you freeze the funds on your wallet.

Considering the average Metaverse network capacity is about 2600 blocks per day, then, if you chose the deposit at the highest rate with and freeze it for 1314000 blocks, you’ll get you funds back and 20% as a reward in 505 days, or a little more than a year and a half.

I won’t tell you about the risks of this investment, you know them yourselves, but, I’m sure this offer will definitely find its buyer, and so, a substantial part of the tokens, which are now being traded, can be withdrawn from the market and frozen for a rather long period of time.

This system is obviously suggested to create ETP deficit in the market, and so, to systematically drive the coin rate up.

According to the flaws, resulted from fundamental analysis, Metaverse is 100% founded by Chinese. China features high local risks and strong influence of the regulator. China’s officials are rather friendly to various HYIPs and Ponzi schemes. Although the suggested project doesn’t seem to be of that kind, it still has some features of it, the most prominent of which is similarity to banking that is to be licensed and strictly controlled by the regulator.

I failed in trying to analyze Metaverse team in terms of corresponding competences; as the names of the founders and the developers don’t provide any information about their careers or a reference to the resource, able to prove it, I don’t think there are any correct competences.

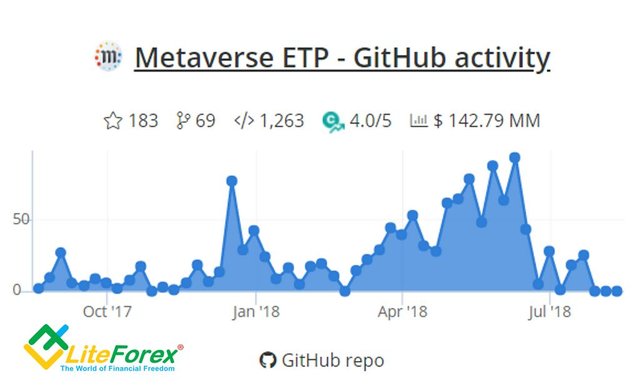

Another thing, I don’t like is that there hasn’t been any information on GitHub since early August, taking into account the Metaverse team’s ambitions plans and great objectives on the official website.

If you apply technical analysis, you’ll get the following:

In the monthly chart, volume profile indicator marks the trading channel’s borders.

For now, the ticker is close to the top border at 3 USD, therefore, according to all laws of trading, to enter a long you need to wait until the ETP price either break the channel border from below and consolidates at the level above it, or it rolls down to the bottom border. I mean, it is not the best moment to buy right now, taking into account the short-term targets.

Summary:

To sum up, I can say that this ETP can be quite promising for a long-term investor.

Metaverse is gradually turning from a project on paper to a really operating business.

The working model has already been developed with user-friendly software and an ability to create your own digital identification and a cryptocurrency asset; there is also a developed wallet for PC and mobile gadgets.

This altcoin can really double its price in the short-term momentum due to a limit number of traded coins and a growing hype.

But if you take decision, based on technical analysis, you’ll need a strong rollback to enter a trade.

In 12H ETP price chart above, there is a series of bearish divergences and the slowing down of the trend. The token can well roll down back to 2 USD, and next, to 1.3 USD, and so, if you want to invest in ETP already know be extremely careful and figure out your risks very well.

That is my ETPUSD fundamental analysis

I wish you good luck and good profits!

Regards,

Mikhail @Hyipov by liteforex.com