So It Begins: South Korea To Tax Cryptocurrency Exchanges With 24.4%

South Korean news agency Yonhap reports that, today, the Government decided to tax cryptocurrency exchanges, using the following scheme:

- 22% corporate tax

- 2.4% local income tax

This is in line with the current taxing strategy used for other types of activities. According to Yonhap:

Under current laws, all corporations with income of over 20 billion won (US$18.7 million) are required to pay 22 percent and 2.2 percent of corporate and local income taxes on their income.

Markets reacted sharply to the news, sending the majority of the tokens in red.

Let's see how this unfolds.

After all, it's just Monday. If past is a good predictor of the future, by the end of this week will see the losses covered and another pump will keep us glued to the monitors for the entire weekend.

I'm a serial entrepreneur, blogger and ultrarunner. You can find me mainly on my blog at Dragos Roua where I write about productivity, business, relationships and running. Here on Steemit you may stay updated by following me @dragosroua.

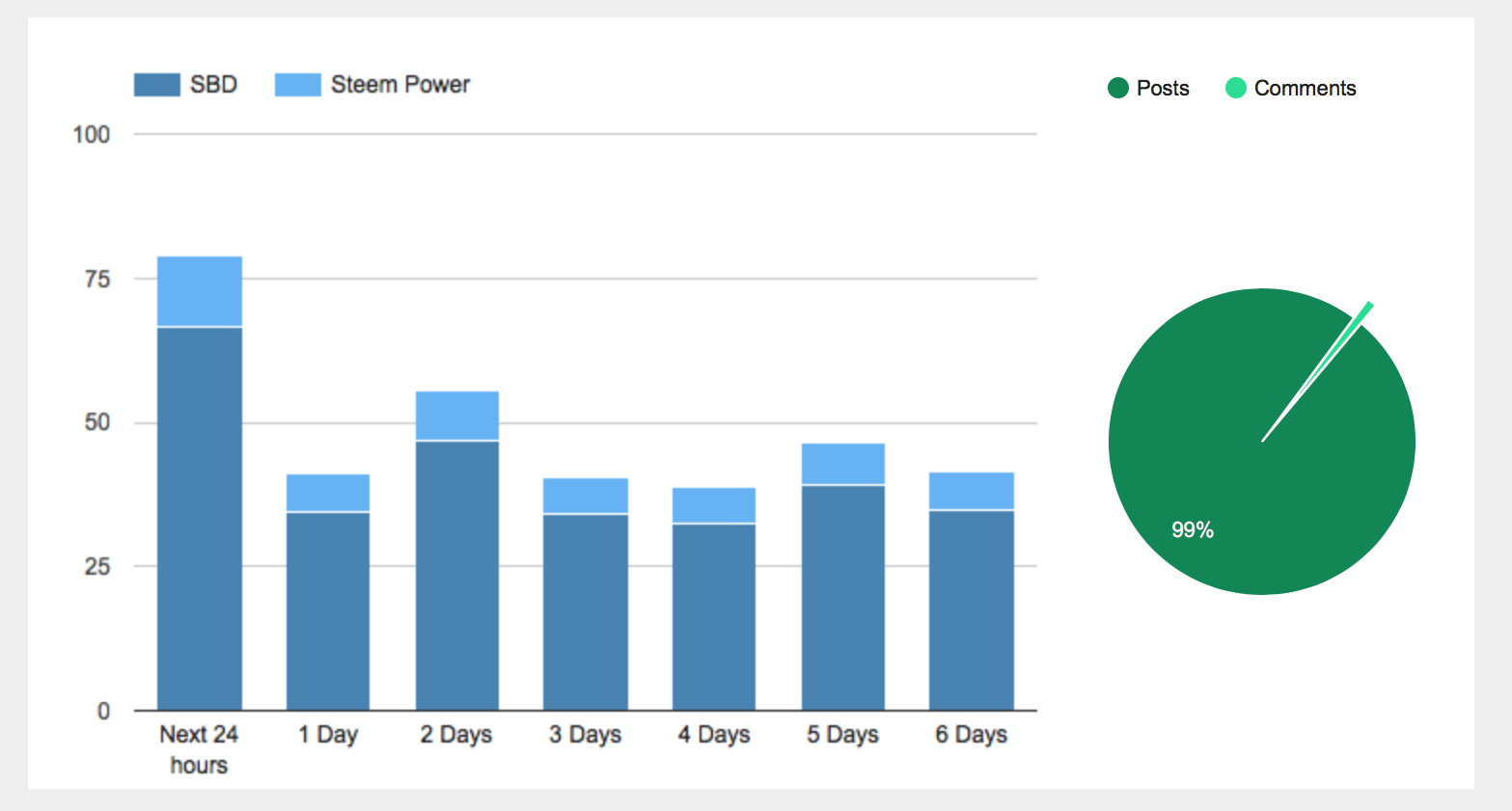

Wanna know when you're getting paid?

|

I know the feeling. That's why I created steem.supply, an easy to use and accurate tool for calculating your Steemit rewards |

I am afraid that the Indian government may soon announce these similar tax structures.

nice, now maybe we can see decentralized exchanges pick up growth.

24% that's simply huge! Why they are taking so much? I know this is basic taxes but from a field where the government did not took any money, now it will be collecting millions. It is simply not fair, and it does not look at all as a free market. Maybe money will be migrating to decentralized exchanges and soon people will start buying goods directly with crypto. When this will happen, nobody will need the government.

I beg to differ. 22% seems like a bargain for S. Korean companies. United States Corporations pay an average 39.6 percent.

With taxation, the exchanges get to stay open instead of outright ban AND the gov't just legitimized crypto-currency exchanging as a business. This is really great news. These exchanges will fill the sting initially, but they're insanely profitable as it is, so I imagine they'll continue to be profitable or will pass on the new burden to the trader in terms of fees. Which might dampen trading volume somewhat, but which might also bring price of Bitcoin in line with the rest of the world.

Speaking to the decentralized exchanges argument. I, too, cannot wait for them to become a reality as they will completely change the landscape. But they're still a ways away from being truly decentralized and scalable and resilient. Cobinhood is a good example of the challenges such exchanges faces to establishing a footprint and then going fully decentralized. So, in the meantime, governments finding ways to work with crypto-currency businesses is good for all concerned.

Could just be propaganda.

This is really a Good News! Now cryptocurrency trading is legal in South Korea as they are collecting taxes on it... Things will be stable very soon..

The exchanges will probably just raise the trading fees to offset the hit from these taxes. I guess the consumer gets the shaft in the end, as always!

Great point! We should push that as the story!

How much do a South Korean investor already has to pay in income taxes on crypto gains? I guess international users will also have to pay for that.

So, what I am getting from this, only the exchanges are going to pay taxes. This will probably increase fees, which are, I assume the only thing that could be taxable.

Hopefully that ends the FUD.

Hopefully. Also, we should see more decentralized exchanges popping out.

I guess some exchanges will move out of South Korea.

they did the same thing here in Colorado with Marijuana. As long as South Korea is interested in regulation and not destruction then the tax can good be a good starting point to legitimize the currency. Lets not forget that South Korea is heavily influenced by western economic power so this could be a beta test for what is to come in the US. "Hit them high and settle in the middle" works in regulations. This sucks for the average person trying to make a business out of it but that is the point of regulation. I'm not saying I'm happy about it but I could have been worse.....

reckon what would happen if a country were to be friendly to crypto?

no taxation for example...and no regulation?

I guess that is only on their profits right? They make a sh*load of money anyway. This is a good thing. The space needs to grow up.

I suppose it makes sense if that's the same as other South Korean business taxes. Seems like it would be difficult to expect cryptocurrencies to become a "mainstream thing" and at the same time expect to get a free pass from having to deal with mainstream laws.

2.4% tax is not too bad hopefully will see a rally soon