Presenting Bankera Loans - Easy & Accessible Crypto-Backed Lending

I've reviewed a fair number of crypto-backed lending services on my blog, none of which offer the ease-of-use Bankera Loans offers. Often, you're met with relatively high loan minimums and difficult lending processes. This is far from the case with Bankera Loans, as they offer low minimum lending amounts at just 25 EUR, while keeping the lending process simple and straightforward.

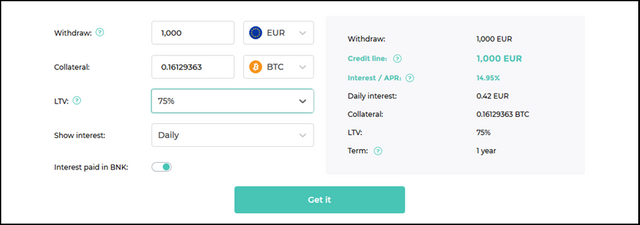

Bankera Loans also allows you to choose very high loan-to-value (LTV) ratios of up to 75%, enabling you to squeeze out maximal loan value from your collateral. In the image below you'll see just how easy it is to get your loan from Bankera Loans. Do note that it only takes around one minute to create an account on the Bankera Loans platform!

Direct Euro & Crypto Loans with Flexible Repayments

The fact that you can take out direct loans in Euro (also BNK - USDT - BTC - ETH - XEM) is a neat feature that I haven't seen too much before. This allows you to gain easy access to fiat currency, without having to sell your cryptocurrency assets.

After you've taken out a loan, you have one year to repay the loan. Repaying it early does not make you incur early repayment penalties. If you take longer than one year to fully repay your loan, it will get extended at a higher APR rate.

While choosing the terms of your loan, all the cost parameters will get updated automatically. This keeps the lending process fully transparent, allowing you to immediately gauge the cost of your desired loan.

You can repay both interest and your principal credit line with any currency that's supported by Bankera Loans. Do note that your account needs to be verified in order to make payments in Euro.

Get Interest Discounts by Using Banker (BNK) Tokens!

By using Banker (BNK) tokens for your interest payments, you will get a pretty significant discount on the amount of interest you're charged. To make use of this discount, make sure you have enough BNK tokens in your wallet to make 1 month's worth of interest payments.

You will currently receive a whopping 3% discount on interest rates, just by using BNK tokens for interest payments!

Excellent Live Support

If you have any questions about Bankera Loans services, you will immediately get the help you need through their live support system. Response time is fast and you will immediately get in contact with a Bankera support agent.

Do not be afraid to ask for help when it's your first time taking out a crypto-backed loan! Bankera Loan's support is there 24/7 to guide you through the process or alleviate any reservations you may have.

Conclusion

Bankera Loans could become a leading loan platform in the future. Their lending process is one of the simplest I've ever come across, that coupled with the fact that they also offer Euro loans makes them a force to be reckoned with.

Do take into account that it's always best to do your due diligence. I, the author, cannot be held responsible if anything goes wrong.

Bankera Loans Website: https://loans.bankera.com/

This looks really interesting. That is pretty cool that they don't charge you any early pay off fees on the loan. That is usually one of the first things I look for when I am looking at a loan because I typically am able to pay my loans off ahead of their due date. Thanks for sharing this! I am going to resteem it!

Yeah, I was quite surprised when I saw that. Their APR rates are somewhat high compared to other lending services, but you definitely save up on other fees. Also, cash out in Euro is pretty nice to have (or USDT in your case)

I suggest everyone to stay away from any Bankera service. They performed an ICO and they will be shut down by the SEC because they didn't comply with KYC or AML rules. Of course, it is your crypto holdings, do whatever you prefer with it.

Not that I doubt what you're saying, but could you add some sources to that statement. Upvoted your post to be on top of the comments.

Not a fair source but I participated on the pre-ICO of the BNK tokens in 2017 when it was supposed to be a traditional bank. At that time, I wasn't required to provide any documentation so they could comply with KYC rules -which I am not supporting, by the way-.

The ICO wasn't restricted -I mean disallowed- to US citizens although Lithuanian ones weren't able of browse the Bankera website; and BNK tokens are working as security tokens. SEC will act against them, sooner or later.

The only service I like to use is the exchange one on the SpectroCoin part of the business.

For people thinking about investing on BNK tokens, I recommend them to take a look at weekly pay out amounts, published on blog.bankera.com. Numbers are showing the business is not growing. Quite risky, but as I said, anyone should do with their own money whatever they wanted to do.

Thanks a lot.

Kindly excuse my noob question. Say I intend to obtain a loan worth 1000$, I have to submit a collateral of crypto worth 1000$.

By the time i want to payback, if the collateral i used has gone up in value, does it mean i will recieve less than the amount of collateral i dropped in the first place?

Sorry ive worked out the answer to that in my head

Congratulations @daan! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!