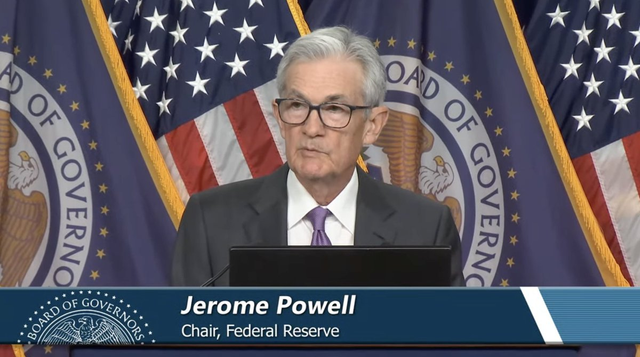

FED cuts rates for the first time in 4 years - let the bull run begin now!!!

The Federal Reserve's decision to cut interest rates for the first time in four years marks a significant shift in economic policy, and for crypto enthusiasts, this could signal the start of a new bull market. Historically, cryptocurrencies, especially Bitcoin, have performed exceptionally well during periods of monetary easing, and with the Fed reducing rates by 0.5% and signaling further cuts throughout the year, the conditions for a crypto boom are rapidly aligning.

Why Rate Cuts Boost Crypto Markets

To understand why this happens, it’s essential to look at the relationship between interest rates and investment behavior. When the Federal Reserve cuts interest rates, borrowing becomes cheaper, encouraging businesses and individuals to take out loans and invest. More importantly, lower rates reduce the appeal of traditional savings accounts and bonds, which offer lower yields. As a result, investors often seek alternative assets that promise higher returns. In the last decade, cryptocurrencies have become a popular alternative investment, particularly for those looking to hedge against inflation and a weakening U.S. dollar.

Bitcoin, often referred to as "digital gold," is seen as a store of value during times of economic uncertainty or inflationary pressures. When fiat currencies lose their purchasing power due to inflation, assets like Bitcoin, which have a finite supply, tend to appreciate. A lower interest rate environment also diminishes the cost of holding non-yielding assets like Bitcoin, which further boosts its attractiveness.

Crypto Thrives in Easy Money Conditions

Cryptocurrencies have historically performed well during periods of monetary easing. In 2020, following the aggressive rate cuts and monetary stimulus in response to the COVID-19 pandemic, Bitcoin and other cryptocurrencies saw massive price surges, with Bitcoin hitting all-time highs. The current cycle of rate cuts could lead to similar conditions. With the Fed funds rate previously as high as 5.5%, a cut of 0.5% is just the beginning, and if the Fed continues on this path, the influx of cheap money into the economy could drive more investment into digital assets.

Furthermore, as traditional financial markets, such as stocks and bonds, become less attractive due to reduced yields, institutional and retail investors alike may flock to Bitcoin and altcoins. The decentralized nature of crypto also makes it a haven for those looking to escape the unpredictability of central bank policies and potential inflation caused by aggressive monetary easing.

The Broader Crypto Market Benefits

While Bitcoin tends to dominate headlines, the broader cryptocurrency market is likely to benefit as well. Altcoins, including Ethereum, Solana, and other blockchain-based tokens, are set to thrive in an environment where investors are searching for high-growth opportunities. As long as the U.S. avoids a severe recession, the rate-cut environment should provide the perfect backdrop for growth in decentralized finance (DeFi), non-fungible tokens (NFTs), and other blockchain innovations.

In conclusion, the Fed's rate cuts set the stage for a booming crypto market. As traditional investments lose their appeal, Bitcoin and the broader cryptocurrency ecosystem stand to gain significantly, potentially triggering the next bull market cycle. With more cuts likely on the horizon, investors should watch closely as the conditions for another crypto surge continue to take shape.