How to Evaluate an Initial Cryptocurrency Offering (ICO)

Posting the link to my latest blog post here, with STEEM covered in the examples.

http://startupmanagement.org/2016/11/24/how-to-evaluate-an-initial-cryptocurrency-offering-ico/

Teaser opening

Initial Cryptocurrency Offerings (ICOs) are the flavor du jour in the sprawling Crypto-Tech market. I’ve been following and analyzing their development early on, in addition to being in private conversations with several entrepreneurs who are planning or have done them already.

At their essence, they represent a fundamental shift into how companies get funded, when compared to the traditional Venture Capital driven methods, as I described these differences in How Cryptocurrencies and Blockchain-based Startups Are Turning The Traditional Venture Capital Model on Its Head. What I inferred from that post is that the way forward is a clever combination of both worlds, the old and the new, a point that Zenel Batagelj from ICONOMI picked-up in ICO 2.0 – what is the ideal ICO?, a good post that I recommend you read.

For background, I’ve already described the Best Practices in Transparency and Reporting for Cryptocurrency Crowdsales in a lengthy post, about two years ago. Re-read it, because much of it still applies increasingly so, and for a new reason: there are several more ICOs today than in early 2015.

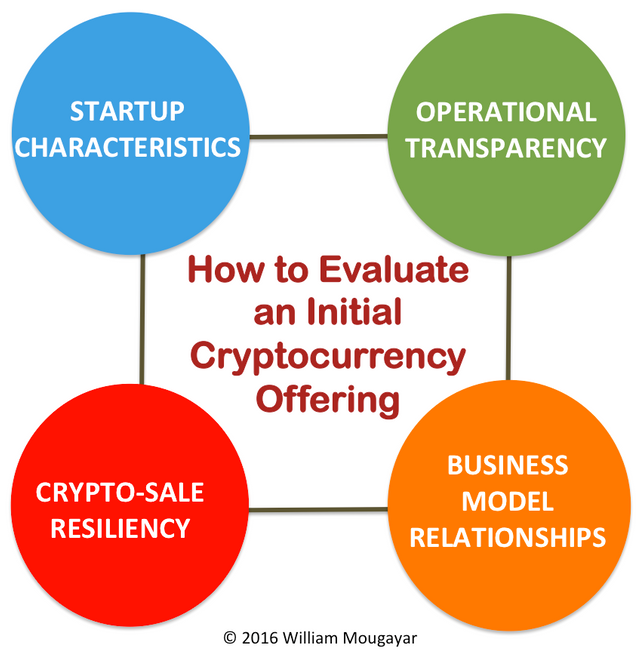

I’d like to expand my own thoughts on how to evaluate an ICO by categorizing the criteria along 4 dimensions:

- Startup Characteristics

- Operational Transparency

- Crypto-Sale Resiliency

- Business Model Relationships

Read more here: http://startupmanagement.org/2016/11/24/how-to-evaluate-an-initial-cryptocurrency-offering-ico/

Hi! I am a content-detection robot. I found similar content that readers might be interested in:

https://startupmanagement.org/2016/11/24/how-to-evaluate-an-initial-cryptocurrency-offering-ico/

good info

Thanks for the information!