Wall Street's Migration To Crypto Continues: Former Bain Manager Opens LatAm Bitcoin Fund

It appears a trend is taking shape. Following a former Goldman HFT trader's massive initial coin offering, another Wall Street-er has come to the dark side of virtual currencies. A former senior manager at consulting firm Bain & Company, is launching a Bitcoin fund, providing access to the cryptocurrency to some of the wealthiest families in Latin America.

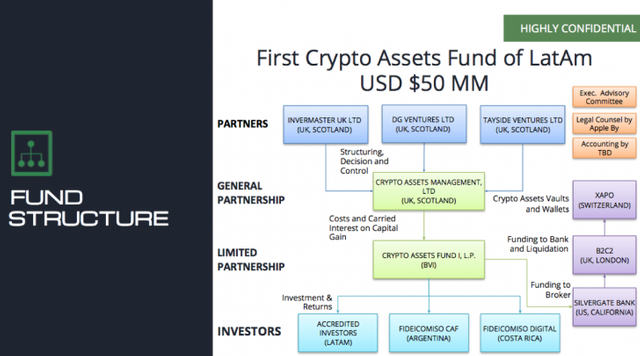

Announced today, the newly formed Crypto Assets Fund, co-founded by former senior manager at Bain, Roberto Ponce Romay, is helping to raise $50m with the purpose of buying cryptocurrencies for family offices. Revealed exclusively to CoinDesk, Crypto Assets Fund (CAF) will invest directly in bitcoin, ether, zcash, ripple, litecoin and dash. As CoinDesk reports,

The first tranche of the fund, estimated to be valued about $10m, is in the final stages of closing, and is expected to be announced by the end of this month.

In interview, Romay explained that the purpose of the fund was two-fold.

First, it was designed to give investors in some of Latin America’s more unstable economies a new way to hedge their investments, and...

Second, it was meant to provide the opportunity to safely learn about these new stores of value for possible future investments.

According to Romay, as the fund's investors are becoming increasingly familiar with the crypto-asset class, the CAF could eventually raise new funds that also include tokens sold as part of initial coin offerings, or ICOs.

"This fund is investor driven," said Romay, who is now the director of investment banking boutique, Invermaster."It is a simple strategy to give access."

"The [investors] wanted to be exposed..."

Investment documents provided to CoinDesk further reveal details about how the British Virgin Islands fund intends to invest capital provided by its limited partners.

Based on previous growth trajectories of CAF’s crypto-assets, the fund lists a minimum target return of 26% per year for three years with an "expected" target return of 71%.

With volatility at record lows across so many asset-classes, is this the beginning of an exodus from Wall Street to Cyber street to take advantage of information-edges and noise?

Source : ZeroHedge

For only the best of ZeroHedge and articles relating to Steem, Follow me @Zer0Hedge

Very interesting article thanks @zerohedge. I upvoted you and followed you. When fund managers start investing the large sums at their disposal we will definitely be on a new uptrend. I do think however that the fees non-etf brokers probably charge mean that there is more room for a hedge fund that covers a wider range of cryptocurrencies. For example one that dives into forums and picks up the sort of insight I got today on Miaidsafe https://steemit.com/cryptocurrency/@katythompson/is-maidsafe-the-next-under-promoted-antshares but then also has the time to contact the companies themselves and validate insights. I'd definitely pay a fee to a company that takes over management of all the private keys of all the cryptocurrencies and insured against theft or hacking.

This is just the first of many like it.

Good news! Adoption by professional investors will bring a lot of money into bitcoin, and since the supply is limited this will make the price to skyrocket!

This is awesome. It was only a matter of time before Wall street saw the advantages of crypto - huge profits, no regulation, and no taxation. This will be great for crypto in general, and we're going to see a ton of money flow into coins we're already holding!

Exactly. Giddy up!

No taxation, r u kidding, you should follow the IRS coinbase case

Have you paid taxes for your crypto profits, though Coinbase or any other exchange?

Wall street and big boys are the worst in the world @zer0hedge

This comment has received a 0.26 % upvote from @booster thanks to: @hamzaoui.

wait until cryptocurrencies are sold by stock exchanges, then we will see a market boom

I feel they'll need to do a lot of catching up with all the platforms being built to trade now.

I wouldn't touch a cryptocurrency fund with a 10 foot pole. Active trading and holding only. Nobody knows where these things are going so a fund is out of the question personally.

Good news for sure! But also bad for dumps if the whales go for massive daytrading.

I write about crypto, personal life, sports and life on my profile. Will soon start blogging about food, travel and my adventures in Japan, South Korea, Taiwan and Philippines. You might be interested, love <3

Interesting they have chosen ripple xrp. I like that one

They have to. Ripple is mainly for banks to centralize things according to Banks needs. I won't be surprised if banks start adopting Ripple for embracing the crypto space.

One day they will find out about Diamond coin...