I been following this Bitcoin buying STRATEGY

One of the first books I ever read talked about a wealth creation method I been using since I was 16 years old, the concept is very simple but hard to master.

The book was "The richest man in babylon"

Babylon was the riches city of its time, it was this way because all the citizens of the city shared ideas of earning and expanding their wealth. Because all the money the city had their land had many luxuries.

They where one of the first to use a written language and to use metal tools instead of stone. They had huge walls and advance defenses.

After the empire fell, archeologists found clay tablets that explain the rules they followed to gain riches. The rules were originally made by the richest man in Babylon which explains the title. There were a total of seven rules, the most important being:

Out of every ten coins you make pay one tenth to yourself, then spend the rest

Over time you will accumulate wealth without doing anything, you can get by just as well as before. The book then goes on to explain that with the money you saved, invest in something that can multiply your money. When a opportunity comes you will have the money, to take the opportunity and make money from it.

These rules are still true to this day, next time you receive a paycheck "pay yourself first" then feel free to spend the rest on whatever you want. ( bills, tax and so on )

Make sure you can tell the difference between wants and necessities, overtime you will not even realize you are using less money and it will feel natural to pay yourself first the 10%. Even when you start earning more, don`t decide to stop working getting rich doesnt happen over night.

This is a method on how to start your journey to success, even if you fail and lose your money in a bad investment "restart" the process. The book describes how some of the richest people to rise to power in Babylon started as slaves.

I may take years but in the end your work and good investments will pay off, this is a lifestyle!

Before I start talking about the Bitcoin buying strategy, lets look at investopedia explanation about dollar averaging (DCA)

What is Dollar-Cost Averaging (DCA)

https://www.investopedia.com/terms/d/dollarcostaveraging.asp

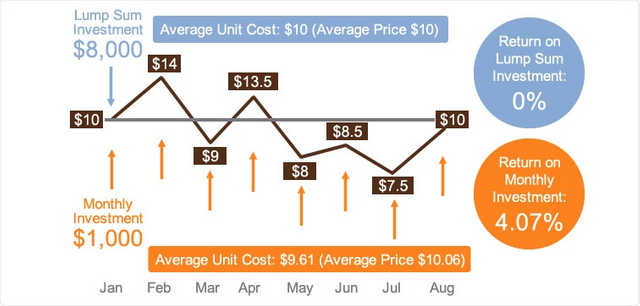

Dollar-cost averaging (DCA) is an investment technique of buying a fixed dollar amount of a particular investment on a regular schedule, regardless of the share price. The investor purchases more shares when prices are low and fewer shares when prices are high.

The DCA technique does not guarantee that an investor won't lose money on investments. Rather, it is meant to allow investment over time instead of investment as a lump sum.

BREAKING DOWN 'Dollar-Cost Averaging (DCA)

Fundamental to the strategy is a commitment to investing a fixed dollar amount each month. Depending on an investor's investment objectives and risk profile, the monthly contributions can be invested in a mixed portfolio of mutual funds, exchange-traded funds (ETFs) or even individual stocks. Each month, the fixed amount buys shares at the then-current prices. As share prices decline, the fixed amount buys a higher number of shares; when prices increase, the fixed amount buys fewer shares. The real value of dollar-cost averaging is that investors don’t need to worry about investing at the top of the market or trying to determine when to get in or out of the market.

Dollar-Cost Averaging Example

For example, assume an investor invests $1,000 on the first of each month into Mutual Fund XYZ. Assume that over a period of five months, the share price of Mutual Fund XYZ on the beginning of each month was as follows:

• Month 1: $20

• Month 2: $16

• Month 3: $12

• Month 4: $17

• Month 5: $23

On the first of each month, by investing $1,000, the investor can buy a number of shares equal to $1,000 divided by the share price. In this example, the number of shares purchased each month is equal to:

• Month 1 shares = $1,000 / $20 = 50

• Month 2 shares = $1,000 / $16 = 62.5

• Month 3 shares = $1,000 / $12 = 83.33

• Month 4 shares = $1,000 / $17 = 58.82

• Month 5 shares = $1,000 / $23 = 43.48

Regardless of how many shares the $1,000 monthly investment purchased, the total number of shares the investor owns is 298.14, and the average price paid for each of those shares is $16.77. Considering the current price of the shares is $23, this means an original investment of $5,000 has turned into $6,857.11.

If the investor had invested all $5,000 on one of these days instead of spreading the investment across five months, the total profitability of the position would be higher or lower than $6,857.11 depending on the month chosen for the investment. However, no one can time the market. DCA is a safe strategy to ensure an overall favorable average price per share.

So how can you follow this wealth creation method to become successful with buying Bitcoin?

Each month take 10% or more ( pay your self first ) from you paycheck and invest it in Bitcoin. You want to spread the buying orders over 4 weeks no matter the price.

( for advance users save the money to bear market, this requires that you are always updated on the market )

Using this strategy and you will be a winner, Bitcoin is a long term asset class with great gain potential. Bitcoin is more then just a investment, its the solution to give people back power over money.

If you have any questions, leave a comment. Also if you liked this article make sure to follow me here on Steemit and upvote/resteem.

Read: https://steemit.com/goal/@rafaljakobsen/my-goal

This Steemit Channel is created to give you a deeper understanding of the "hidden" and growing crypto world.

News will be shared here to keep giving my community members information on the crypto world today.

Here you can expect information regarding Bitcoin, Blockchain and Crypto Assets.

⚠️⚠️DISCLAMER⚠️⚠️

I am a hobby investor. I am not a financial advisor. Please do not take anything I say as tips or advice. I am only sharing what I am thinking, and what I am doing.

Always do your own diligence

NEVER invest any more then you are willing to lose.

Start Bitcoin mining today with SGG ( recommended cloud mining )

http://shortcut-to-riches.swissgoldglobal.com/en/cryptocurrencies

Feel free to COMMENT and RESTEEM this article!

Can I assume that you are a fellow Dane? (O:

Like the article. Good information for people just starting out, or for someone who is a bit tepid about entering this volatile market!

Thanks @jmdk2000, you can take this strategy many directions. I just try to make it simple so people understand. What is "a fellow dane" ?

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvote this reply.

Pretty Cool function.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.investopedia.com/terms/d/dollarcostaveraging.asp

Yes, I linked to source in the article.

Your strategy is pretty simple - that's the beauty of it, I think. Will try this out with my own investments as well. Thanks @rafaljakobsen!

Yes its a pretty simple strategy, its all about making it a habbit.

I'm afraid that when it comes to habits, I suck. What mindset do you adapt to help you get through with this?

I write down my goals/habbits and track them everyday. I try to get strikes and if I make my targets I give myself rewards :-)

Nice post

@hidayatimn thanks!

I have been hacked

@mosesogenyi I will check it out :-)

whether it can be assured in such a way..??

Nothing is guaranteed. It is a common investment strategy, but if you were guaranteed to always make money, everyone would do it. It is meant more as managing risk while maximizing returns.

@ahyar94 what do you mean?

if we buy bitcoint, whether it will be able to convince the future..

Bitcoin have risks, but you can use this strategy to everything :-) Diversifying your portfolio is also important.

I will try, thank you for the information @rafaljakobsen

What @jmdk2000 said :-)

Beautiful pic friend

Thanks @fendy78 :-)

Good advice, i was just thinking about how to best invest money into bitcoin, this strategy seems interesting.

Thanks :-) I think Bitcoin is a great asset class, but also remember to diversify.

Yes, im trying to spread my investment off differnet things.

Dont put all the eggs in the same basket, as they say.

So its not to late to get on the bitcointrain then?

Good! Bitcoin is still in ALPHA, its far from to late to invest in Bitcoin :-) I would recommend to learn the fundementals before you start buying Bitcoin, it will give you a better picture of what it is.

This is a amazing article that can help you understand:

https://www.upfolio.com/ultimate-bitcoin-guide

I don't know exactly about bitcoin!!! How can be it so influented???

I recommend to read this so you understand what Bitcoin is better:

https://www.upfolio.com/ultimate-bitcoin-guide