Bitcoin Popped Its $5000 Cherry Today – What’s Next?

Whoo over 200 followers. Thanks folks :) Sorry I have been MIA, these last couple of months have been very tough and this last month in particular has been unbelievably awful. I almost feel like this bitcoin run has been a silver lining of sorts in a string of disasters that is still ongoing.

With the bitcoin price, people on one side of the fence are saying it’s in a huge bubble and calling a price collapse, whereas people on the other side of the fence are calling for anywhere from $30,000-$500,000 bitcoin price in the next few years.

I think the latter camp shouting ‘to the moon’ is more likely to the mark. I do think there are still possibilities for huge retracements before subsequent run ups, but cost averaging with some dry powder in the wings is better than just staying on the sidelines until a big 40% retracement hits. Though a massive correction is possible I think it is also very possible that we will only see periods of slow down and smaller pullbacks until $7,000 or maybe even $10,000.

However I do think that there is a big threat to bitcoin that exists that not many are talking about. We’ll get to that later. I do hope that the newly minted bitcoin millionaires will consider turning at least some part of their fortune into tangible real world wealth that will benefit their lives, as the true value is not in the 1's and 0's themselves.

Sorry if this post is scattered and not formatted very well, I’ve been feeling a bit like I’ve got lava rocks in my brain these past several weeks, and I want to get a post out because I’ve been meaning to write about some of these things for awhile.

About six weeks or so ago I had dinner with an old contrarian hedge fund friend to get some feedback on a couple of non-financial endeavors, and he told me like FIVE times, “ANNIE, SELL EQUITIES AND BUY BITCOIN” – the force he put behind this was a bit out of character. I had already been planning on buying since the Marfa event, but after dinner I was like dang.. he's not joking around, I need to do this like right now. This is a pretty darn smart dude with a great team of analysts who has had ten figures under management – I trust his judgement and it was fortunate that I listened, though some SHTF in my world a couple weeks later and I didn’t finish rotating out of equities and my bitcoin buying spree got cut a little short before this price run up while I had to deal with some things.

You might not be seeing a whole lot of them talk about it, but many hedge fund managers, institutional investors, 'traditional' venture capitalists, and central banks will be moving into the crypto game in a big way. Many investors with enough brain cells to see the ‘big picture’ these past several years and trade accordingly have been burnt repeatedly and lost a lot of money despite having made the right call.

Common sense doesn’t have a place in these markets anymore, in order to make money people have instead had to twist their minds to comprehend the perversions and manipulations of the modern day markets – they’re getting tired out and are running out of fucks to give about keeping money on the line at huge risk of collapse just to kick the can a little further and make a few bucks navigating these overbought waters. When these folks look at bitcoin and the blockchain, they see a lot of possibilities and opportunity. It won't just be Chinese buying and widespread adoption in other Asian countries, we could possibly be looking at a whole new paradigm in another ten years.

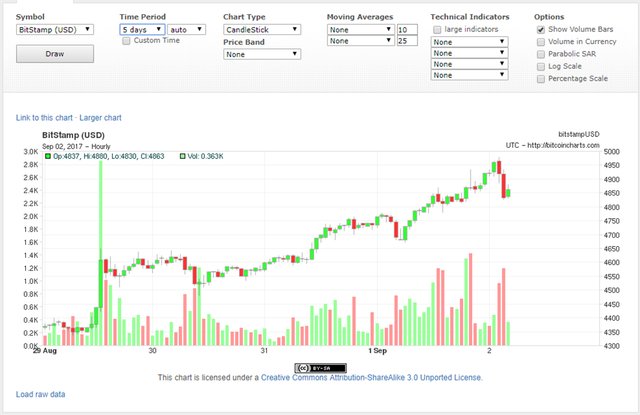

You’re seeing headlines like “Is Bitcoin the New Gold?”, and I think this idea has validity. With no end in sight to the gold market manipulation and the end of the era of USD/FRN global hegemony drawing ever closer, more and more you will be seeing money flowing into bitcoin as the risk off trade of choice. If you look at the price action this past week, you see both gold and bitcoin climbing on Aug 29, only to have gold smashed while bitcoin keeps on keeping on in a natural seeming chart progression. I do believe that China could end the gold market price manipulation - if they wanted to. But if they are still buying, why would they want to pay more?

Gold Flash-Crashes Below $1300 -

http://www.zerohedge.com/news/2017-08-30/gold-flash-crashes

Indonesia Barters Coffee and Palm Oil for Russian Fighter Jets -

https://www.bloomberg.com/news/articles/2017-08-07/indonesia-barters-coffee-palm-oil-for-russian-fighter-jets

Diversification is your friend, beware the Bitcoin Killer

Now with that said, I have long suspected The Bitcoin Killer to be in the works, and a few weeks ago was able to confirm with some crypto insiders that this thing is in fact already being built by a very well funded private group of Chinese. I suspect that they are backed by the Chinese “Shadow Gold”.

Besides their officially reported gold holdings, China has likely amassed somewhere between 10,000 tonnes and 50,000 TONNES of ‘shadow gold’ – I suspect the number to be at least 16,000 tonnes but and not going to get into all of that right now. The gold backed crypto currency being built would likely be hooked up to an international gold bar dispensing ATM network (these ATMs already exist) at some point, possibly even with places where you can deposit gold for the crypto also. It would likely be supported by multiple state actors and would maybe have the ease of use of debit cards with immediate transaction speeds available.

Imagine a cryptocurrency with all of the benefits of bitcoin, withdrawable in actual physical gold around the world, attached to a decentralized global vault system. I think it could be ready in as little as 18 months, however I think it will much more likely be held as an invisible checkmate, and that the actors involved are likely also getting into the bitcoin game and will use bitcoin for as long as it serves them well, potentially several years.

Diversification is your friend. Don’t keep all of your eggs in the bitcoin basket - other cryptos, gold and silver (don’t overlook the silver), real estate and income producing assets, a business, a little bit in equities, maybe even some timberland or a productive farm, a little bit of cheap and manageable debt that is working, diversification will serve you well in a likely highly unstable financial environment during this next decade or so.

The above story is outdated, and bitcoin’s marketcap is close to the $175B mark today, but the infographic is truly a must view in order to get some perspective. Even the $650 Trillion to $1.3 Quadrillion derivatives markets estimates are in my opinion likely very underestimated. I was unable to adequately analyze the current day derivative situation, but given the continued hubris of the finance industry and the City of London rehypothecate into infinity issue, I suspect that the derivatives markets are closer to $6 Q to $20 Q. A quadrillion dollars looks like $1,000,000,000,000,000. People like to say the derivatives will balance but given the nature of the parties, we know that many could not be allowed to fail in the event of a mass derivatives market implosion event, but legally the counterparties will likely have to be satisfied as well. We could see another round of massive bail outs that dwarf the last crisis. What does that do to the value of fiat and the fiat price of bitcoin? I think we will see much higher bitcoin prices in today’s fiat values, but when people are calling for $1,000,000 bitcoin I wish they would answer the question of how much $1,000,000 would be worth at that time compared to today.

Friend said in July when bitcoin was at $2,000 that this might be the last chance to pick some up cheap. I said $2,000 doesn't seem like a bargain. A little regretful about that now...

If it felt too hard to buy at 2k imagine how hard it will feel for people to buy at over 4k. I have heard too many people saying they're going to wait til the price drops by 30-60% before they will buy any, but that's what they were saying at 2k as well. I hope you will consider at least buying a little at a time here and there instead of completely staying on the sidelines until the 'perfect' time to enter. Keep at least most of it in a private wallet you hold the keys to.

Yeah, no joke. Good advice -- thanks!